Remain Bullish – But Watchful

Remain bullish because the bull market remains in place, with most indexes making new highs as recently as last week. Support levels continue to hold on short-term pullbacks, technical indicators remain on buy signals, and the market’s favorable season usually lasts into April/May.

Remain bullish because the bull market remains in place, with most indexes making new highs as recently as last week. Support levels continue to hold on short-term pullbacks, technical indicators remain on buy signals, and the market’s favorable season usually lasts into April/May.

However, be watchful – because the rally is increasingly abnormal, is unlikely to be sustainable much longer, and could change quickly.

The main problem, besides the market being at overvalued levels, is that in spite of the strong jobs report showing 295,000 new jobs created in February, the overall economy has been slowing since shortly after the Fed ended its QE stimulus last October.

The stock market does not like a slowing economy even when the Fed’s easy money policies are in control. During the recovery from the 2008 meltdown, the economy stumbled several times when the Fed thought it was strong enough and allowed stimulus programs QE1, QE2, QE3 to expire. Each time, the Fed had to come to the rescue with a new program to halt the slowing before it dropped the economy into recession, (although in 2011 it did not react until the S&P 500 was down 20%). The latest rescue was ‘QE to infinity’, the program it ended last October.

In spite of assurances from Wall Street and the Fed that the economic recovery remains on track, all three of the economy’s major driving forces; consumer spending, the housing industry, and the auto industry, say otherwise.

Recent reports were that Consumer Spending, which accounts for 70% of the economy, declined in January for the second straight month. Retail Sales unexpectedly fell 0.8% in January after declining 0.9% in December. Consumer Confidence declined from 103.8 in January to 96.4 in February.

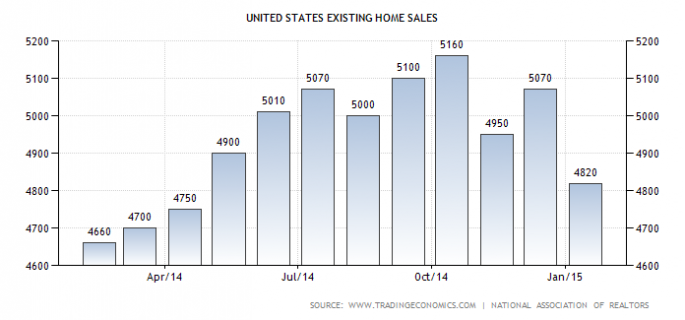

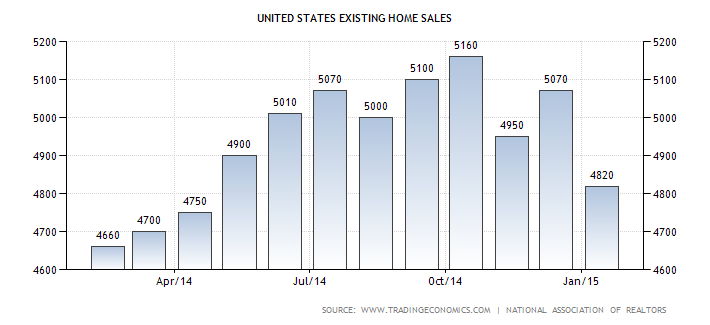

From the housing industry, Existing Home Sales peaked in October and are declining.

Meanwhile, new housing starts declined 2% in January, while permits for future starts fell 6.7%. Construction Spending declined again in January, down 1.1% versus the consensus forecast of an increase of 0.3%.

Auto sales growth slowed last fall, bounced back but have now slowed again for two straight months.

In overall manufacturing, Factory Orders fell 0.2% in January, the sixth straight monthly decline. The ISM Mfg Index declined again in February, to 52.9 from 53.5 in January. Reports from the Fed’s regional areas include that the Chicago PMI plunged from 59.4 in January to 45.8 in February, beneath the recessionary 50 line. The Richmond Fed Mfg Index fell from 6.0 in January to 0 in February. The Dallas Fed Mfg Index plunged from already negative -4.4 in December to -11.2 in January.

The severe weather in much of the country since mid-January will not help.

As I wrote in last week’s column, the market continued higher as it looked at evidence of the economy slowing as a positive, expecting that it ensured the Fed would not begin raising interest rates any time soon. However, some economists and Fed members, think otherwise.

They believed even before Friday’s strong jobs report that the Fed needs to continue on its course toward normalizing its monetary policies, begun last year with the removal of QE stimulus. Even though it may risk a small recession now, the concern is that the Fed is blowing stock and debt bubbles again by continuing the easy money policies, which may guarantee a bigger meltdown later.

Meanwhile, markets demonstrated by their reaction to the jobs report that they are still more focused on the Fed’s intentions than the economy.

Whereas the weak economic reports supported the expectation that the Fed would not raise rates anytime soon, the strong jobs report panicked stock and bond markets into sharp plunges, expecting that June is back on the table as the likely time for rate hikes to begin. The Dow was down triple-digits, and bonds tumbled more than 2% in reaction.

However, it will take a few more days to determine whether the jobs report will remain important to the market.

I say that because, as long-time readers know, I have always referred to the monthly jobs report as ‘the big one’. That is because it almost always comes in with a surprise in one direction or the other, which in turn creates a one to three day triple-digit move by the Dow in one direction or the other. The other side of the pattern is that the initial kneejerk reaction is usually reversed in subsequent days and the market goes back to whatever was its previous focus.

While the market’s initial reaction to the jobs report this time is that it means the Fed will raise rates soon, it may well reconsider and return its focus to the slowing overall economy and confidence that the Fed will delay raising rates for quite some time.

If it does not reverse its initial reaction to a jobs report this time, there may be a problem.

So again, my work says we should remain bullish for now – but watchful, particularly of whether support levels hold.

By Sy Harding

Sy is president of StreetSmartReport.com and editor of the free market blog Street Smart Post. Follow him on twitter @streetsmartpost

Find more: Contributing Authors