Russia is now China’s biggest oil partner — and it’s a huge problem for Saudi Arabia

Saudi Arabia has long trumped Russia in the Chinese oil market.

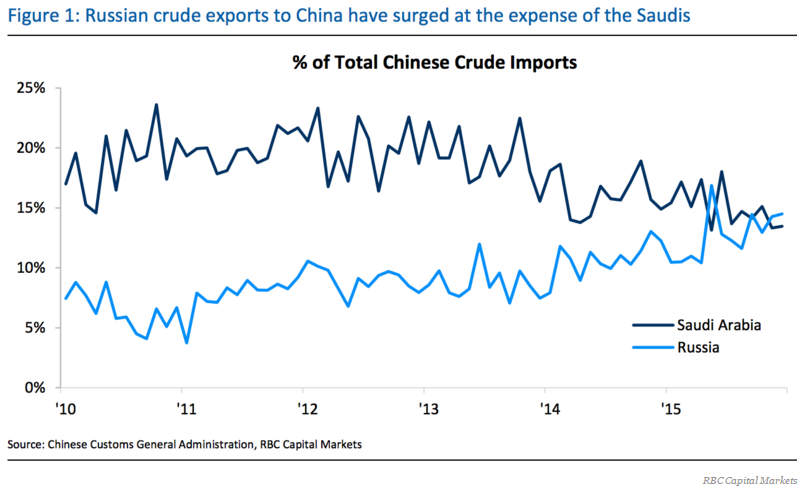

The Saudi share of Chinese crude imports at the beginning of the decade was about 20%, while Russia’s was below 7%, according to data cited by RBC Capital Markets.

But now the Russians are creeping in — and the Saudis are getting nervous.

“Russia is the biggest rival to the Saudis in the single-largest oil demand growth country in the world,” RBC Capital Markets’ commodity strategist Michael Tran wrote.

“The rising tide of Chinese growth has meant that notional volumes for both countries have increased in the years since, but Russia’s gains have been outsized,” he continued.

“The Kingdom now finds itself neck and neck with Moscow for the lead in Chinese market share, with both jostling in the 13-14% range, yet the momentum resides with the latter.”

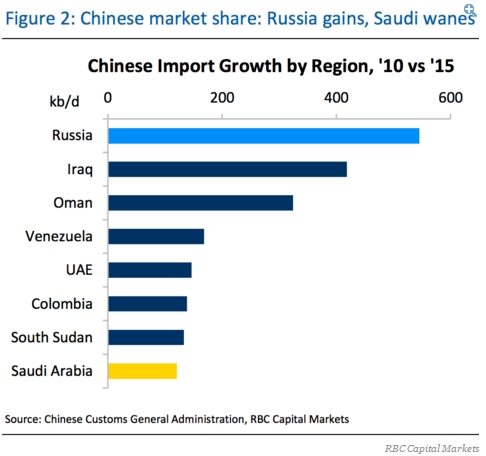

Notably, the Saudis managed to increase exports to China by only about 120 kilobarrels a day over the past five years — a growth rate that was beaten by seven other countries including South Sudan and Colombia, according to figures cited by Tran.

Meanwhile, Russia increased exports by 550 kilobarrels a day in the same period.

Moreover, Tran continued, Russia even managed to overtake the Saudis as the biggest crude exporter to China in December and three other months in 2015. While this detail may not sound particularly impressive, it’s worth pointing out that the Saudis have lost the top spot only six times in the past five years.

Interestingly, part of Russia’s success in China has been attributed to its willingness to accept Chinese yuan denominated currency for its oil. (And not, as others have suggested, because of any sort of allegiance to the Sino-Russo friendship.)

On the flip side, “Saudi Arabia is losing its crown as its selling prices in Asia haven’t been attractive enough,” Gao Jian, an analyst at SCI International, a Shandong-based energy consultant, told Bloomberg back in June.

On the flip side, “Saudi Arabia is losing its crown as its selling prices in Asia haven’t been attractive enough,” Gao Jian, an analyst at SCI International, a Shandong-based energy consultant, told Bloomberg back in June.

“If Saudi Arabia wants to recapture its number one ranking, it needs to accept the renminbi for oil payments instead of just the dollar,” Gordon Kwan, the Hong Kong-based head of regional oil and gas research at Nomura Holdings Inc., told Bloomberg back in June.

There are certainly other things the Saudis could theoretically do to capture market share.

“Owning refineries in key demand regions guarantees market captivity,” Tran wrote. “This has historically been part of the Saudi playbook and the recent reported interest in acquiring stakes in Chinese refineries is a strategic move that would guarantee the Kingdom a seat at the table in the preeminent region for demand growth.”

Basically, if the Saudis own the refineries, then their oil will be sold there.

In any case, the upshot for the overall oil market is that we probably won’t see Russian-Saudi coordination in the oil sector anytime soon, Tran argued.

“The recent meeting between the Russian government and its domestic oil company execs introduces a glimmer of promise for potential coordination with the Saudis and other OPEC countries, but the probability of a production cut remains low,” he wrote.

In sum, Russia has moved into China — and the Saudis aren’t loving it.

“Is there a sense of urgency from the Saudis?” Tran said. “You bet.”