Greece’s Path to New IMF Loan Grows Even Rockier Following Leak

-

IMF officials discussed smaller surplus target, WikiLeaks says

-

Fund has been pushing euro-area nations to offer debt relief

Greek Prime Minister Alexis Tsipras may be alienating the International Monetary Fund just when he needs it most.

The IMF has questioned whether the goal of reaching a fiscal surplus of 3.5 percent of gross domestic product, agreed to in last year’s euro-area bailout of Greece, is realistic. In the transcript of a conference call published by WikiLeaks on Saturday, the fund’s European Department director, Poul Thomsen, suggests the IMF would accept a revised goal of 1.5 percent. Thomsen has said euro-area countries would have to offer more debt relief if the target is loosened.

That scenario would take some fiscal pressure off Greece while setting the stage for a new IMF loan. Yet instead of seizing on that negotiating room, Tsipras added to tensions: He suggested fund officials weren’t negotiating in good faith, highlighting a different part of the transcript that he said shows the IMF considering a plan to cause a credit event in Greece. IMF Managing Director Christine Lagarde dismissed that accusation as “ridiculous” and said her staff has her full confidence.

“The idea that the Greeks are better off without the IMF is ludicrous,” said Jacob Funk Kirkegaard, a senior fellow at the Peterson Institute for International Economics in Washington. “There’s no way that Greece is going to get any meaningful debt relief without the IMF.”

Talks on a new loan from the IMF were in their infancy even before the leak. The IMF and Greece haven’t discussed how much the country would borrow, according to a person familiar with the talks. The IMF is unlikely to discuss hard numbers until euro-area countries work out how much debt relief they’re willing to provide, said the person, who asked not to be identified.

Second Installment

Euro-area governments are reviewing whether to release the second installment of an 86-billion-euro ($98 billion) bailout for Greece. A new IMF loan would be separate from the European bailout and would replace a 28-billion-euro program canceled in January.

Lagarde said in a letter to Tsipras on Sunday that a deal on a new loan is “a good distance away,” adding that the fund “can only support a program that is credible and based on realistic assumptions.” She asked Greece to respect the privacy of the IMF’s internal discussions and ensure the personal safety of its staff.

A Greek government spokesman who asked not to be named, in line with policy, said Tsipras’s government strongly denies any involvement in the taping or leaking of the conversations.

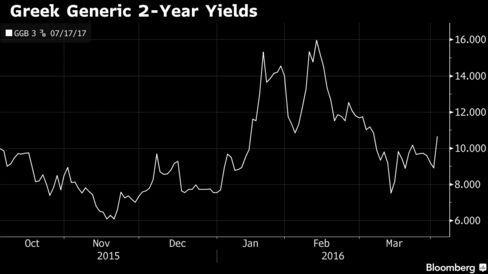

Greek bonds fell on Monday, with shorter-dated yields rising the most in almost two months.

The leaked conference call involved Thomsen, Greece mission chief Delia Velculescu and IMF official Iva Petrova. Such internal discussions usually aren’t shared widely, said Andrea Montanino, who served as executive director at the fund for countries including Greece.

“I’m pretty sure the IMF will do an investigation into how this came out,” said Montanino, now director of the global business program at the Atlantic Council in Washington. “It’s quite serious.”

He remains optimistic the fund will agree to provide new financing to Greece, though the amount will probably be smaller than past bailouts.

Sustainable Path

The IMF has argued that some combination of Greek spending cuts and European debt relief will be required to put the country’s debt on a sustainable path.

In a February blog post, Thomsen said Greece would have to cut spending by 4 percent to 5 percent of GDP to meet its “ambitious” surplus target. The fund doesn’t see how Greece can do that without “major savings” on its pension system, he said. Tsipras has ruled out further pension cuts.

“Could a primary surplus target well below 3.5 percent of GDP make the necessary pension reform less demanding? Perhaps, but that would necessitate more debt relief,” Thomsen wrote.

Failure to win the IMF’s endorsement will hurt the credibility of Greece’s recovery plan, Kirkegaard said.

“Markets recognize correctly that, without the IMF, the willingness of national parliaments to give Greece meaningful and necessary debt relief will be very limited,” he said.

Source: Bloomberg