Dollar Declines, Gold Gains With Industrial Metals

-

Yen climbs as traders react to Trump’s first days in office

-

Japan’s Topix falls while Shanghai, Taiwan equities advance

The dollar slumped after Donald Trump in his first days in office offered little news on his plans to boost growth while stirring concerns over protectionism. Metals and Asian shares outside of Japan rose.

The U.S. currency fell against its major peers and gold added to a four-week advance. Japan’s Topix index fell on the strengthening yen as Asian traders reacted for the first time to Trump’s inauguration. Shares in mainland China and Taiwan climbed. Copper paced gains among industrial metals as the U.S. president reiterated plans to rebuild infrastructure.

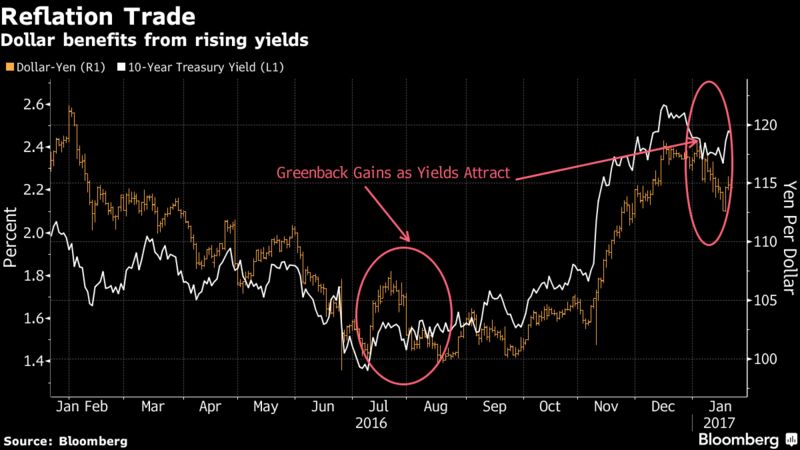

Trump began work as U.S. president after saying he’d place American interests at the forefront of his agenda. His pro-growth campaign-trail pronouncements helped drive a rally in equities since November, while the dollar surged and bonds slumped. Some of those trades are unwinding this month as investors assess whether those moves had pushed prices too far, too fast. Money managers will be dissecting earnings from some of the world’s largest companies this week with Alphabet Inc., Samsung Electronics Co. and Alibaba Group Holding Ltd. all reporting results.

“Markets are now waiting for more evidence that Donald Trump will deliver on fiscal stimulus and deregulation,” said Shane Oliver, Sydney-based global investment strategist at AMP Capital Investors Ltd., which manages about $120 billion. “Shares remain vulnerable to a further correction or consolidation in the next month or so.”

Here are the main moves in markets:

Currencies

- The yen rose 1.1 percent to 113.33 per dollar as of 3:04 p.m. in Tokyo.

- The Bloomberg Dollar Spot Index slid 0.6 percent. It has fallen for four straight weeks, its longest retreat since February. The dollar lost 0.7 percent against the South African rand and 0.8 percent versus the Mexican peso.

Commodities

- Gold rose 0.5 percent to $1,216.62 an ounce. The metal has increased in 10 of the past 11 sessions.

- West-Texas Intermediate crude oil was down 0.1 percent at $53.20.

- Copper futures jumped 1.5 percent in London and aluminum added 0.8 percent to the highest since May 2015. Lead and zinc rose at least 1.1 percent after Trump reiterated plans to rebuild U.S. infrastructure.

- Iron ore dropped 2.1 percent, bringing its four-day decline to almost 5 percent. Iron ore is headed for a sharp decline as higher-grade supplies from Brazil and Australia are set to increase, according to Citigroup Inc.

Stocks

- The Shanghai Composite rose 0.3 percent, while the Hang Seng index was little changed, paring an intraday advance of 0.8 percent. Taiwan’s Taiex index climbed 1 percent.

- Japan’s Topix Index lost 1.2 percent, its first decline in four days, led by exporters.

- India’s S&P BSE Sensex increased 0.4 percent, rebounding from Friday’s 1 percent drop.

- Australia’s S&P/ASX 200 Index fell 0.8 percent, after sliding 1.2 percent last week. The gauge reached the highest since May 2015 earlier this month.

- Contracts on the S&P 500 Index declined 0.3 percent Monday after the gauge advanced 0.3 percent on Friday.

Bonds

- 10-year Treasury yields declined 3 basis points to 2.441 percent.

- The yield on 10-year Australian government bonds lost 3 basis points to 2.76 percent.

Source: Bloomberg

Related Posts

Dollar Drops on Yellen Comments, China Shares Rise: Markets Wrap

Dollar Drops on Yellen Comments, China Shares Rise: Markets Wrap Yen lost 0.4 percent to dollar in Tokyo after eight days of gains

Yen lost 0.4 percent to dollar in Tokyo after eight days of gains Japan, Australia, Hong Kong, South Korea stock indexes gain

Japan, Australia, Hong Kong, South Korea stock indexes gain Asia Stock Selloff Eases as Yen Weakens With Gold: Markets Wrap

Asia Stock Selloff Eases as Yen Weakens With Gold: Markets Wrap Dollar, U.S. futures hold gains, Topix leads markets in Asia

Dollar, U.S. futures hold gains, Topix leads markets in Asia