US Dollar Predicted to Turn Higher

The Dollar has struggled through the course of 2017 as the solid run higher noted in late 2016 fades.

There are a number of cause being attributed for the weakness; yet as we note in this piece consensus is not established ensuring forecasting the currencies next moves are made all the more harder.

Yet, there is the belief that the Dollar is too low based on the signals the strong economy and interest rates are giving out.

US interest rate yields have are seen to be moving higher once again, yet the USD remains weak.

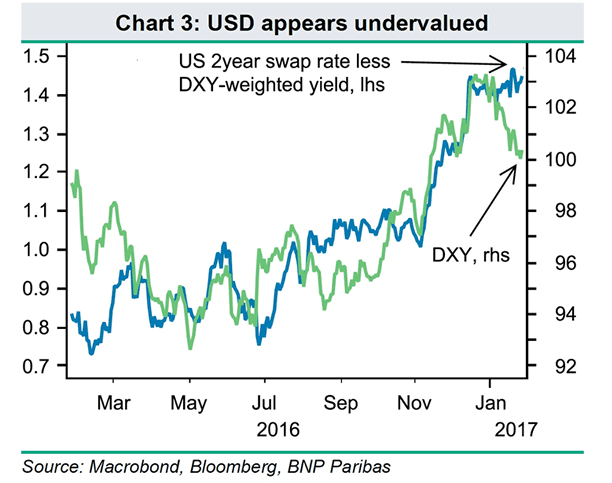

This is a peculiar scenario for currency analysts who observe that the US Dollar tends to follow the progress of interest rate yields:

Based on the above, the Dollar should naturally be higher.

Now analysts at leading investment bank believe it is now time for yields and the US Dollar to meet once more.

And, this coupling is likely to be driven by a US Dollar bounce.

“We think the recent USD weakness is unwarranted and recommend reloading USD longs,” says Steven Saywell, Global Head of FX Strategy at BNP Paribas in London.

The Dollar has Disconnected

One of the key discussions in global FX at present is the Dollar’s disconnect from interest rates, as shown in the above graphic.

According to Hans Redeker at Morgan Stanley, the disconnect between the US Dollar and yields is being driven by politics.

“A politically-driven risk premium has sneaked into USD valuations, as investors have digested the new US administration’s actions and rhetoric on trade,” says Redeker.

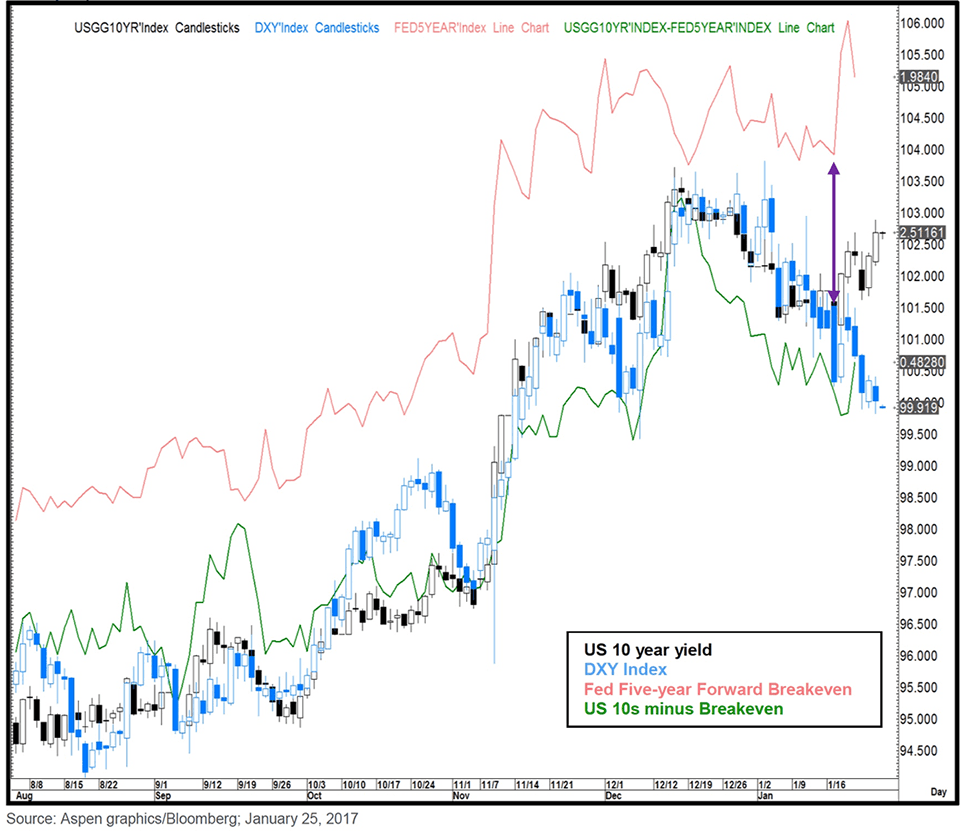

Meanwhile, analysts at Citi argue that the wedge is being driven by heightened inflation expectations which impact on real rates – and real rates they believe are the driver of USD now.

“It is interesting to note that the divergence which began last week also coincides with a spike higher in the inflation expectations to new highs in the trend. Once again, real rates and the DXY seem to be moving together and this should be watched,” says a note from Citi.

Trying to understand the Dollar’s movement of late sees Citi analyse the US Dollar’s relationship with five-year Forward Breakeven Inflation Rate which is deemed a proxy for inflation expectations while also looking at the nominal ten year yield minus inflation expectations (“real rates”).

US inflation is rising faster than expected, as signalled by CPI reaching 2.1% (its highest level since 2014) and average hourly earnings at 2.9% y/y (their highest level since 2009).

That there is apparent disagreement on the cause of the split between bond yields and the Dollar begs the question of whether or not we can trust analysts when they say the Dollar is due a recovery.

If we don’t know what has caused the Dollar’s underperformance, can we be sure we know what will allow it to recover?

While Citi point the finger at inflation expectations for weakness, BNP Paribas’ Saywell believes that it is inflation that will force the Dollar higher:

“A still tighter labour market could make the Fed sit up and think about a faster tightening cycle, especially given the high likelihood of growth being above expectations going forwards.”

BNP Paribas rates strategists stress that US yields are headed higher still, especially following recent hawkish rhetoric from Fed Chair Yellen.

At 1.22%, the team calculates that US 2y yields are 50bp lower than the Fed implied medium dots of 1.72%.

“Even at current yield levels, our own measure of the USD (DXY) versus the US weighted average 2y yield advantage signals that the USD sell-off is unwarranted,” says Saywell.

Political Wedge

As mentioned, Morgan Stanley say the US Dollar is lower than where it should be because of political considerations.

And they argue it is politics that justify a buy on the Dollar as they believe Trump’s policies are ultimately supportive of the Greenback.

“The US aiming for less imports may exacerbate the international USD shortage. Particularly so, coming on the back of the US paying fewer bills abroad and US banks reviewing credit risks of non-US borrowers (owing to slowing business prospects),”

Morgan Stanley believe this will eventually reduce US banks’ foreign asset holdings which should in turn place upward pressure on the Dollar.

Yet, BNP Paribas meanwhile warn that politics could prove to undermine their long-Dollar call.

“The risk to the bullish USD view likely surrounds the unpredictability of the new US President. It may take time for Trump and Congressional Republicans to agree on tax plans. Furthermore, consumers and businesses may be more optimistic, but are choosing to wait to see how policy plays out before committing actual money,” says Saywell.

The Dollar has certainly started moving higher once more. It is back above 100, therefore perhaps it is finally playing catchup.

However, we will be watching two events very closely this week for confirmation that this recovery is sustainable – the Fed meeting on Wednesday and US employment data on Friday.

A Busy Week for the Dollar

Yet it is a busy week ahead for US Dollar with the US Federal Reserve meeting on Tuesday and the Non-farm payrolls report out on Friday 3 February.

“The USD could start benefiting from potentially strong economic releases and a more hawkish Fed rhetoric,” says BNP Paribas analyst Leonard.

Morgan Stanley agree that the Fed should be followed closely.

“Our analytical focus remains on USD. The past week’s USD downward correction may be challenged when the Fed releases its statement on Wednesday,” say Morgan Stanley.

Bearing in mind that US financial and monetary conditions have eased while data continue to come in on the strong side.

BNP Paribas FX Positioning Analysis shows USD long positioning has now been cut back substantially, with the score now at +1 (on our scale of -/+ 50).

This suggests there is good capacity for the market to quickly load up on long US Dollar positions once more.

“We therefore recommend taking advantage of current USD weakness to build USD longs and remain long the USD vs EUR, JPY, CAD and AUD via options,” says Leonard.

Source: PoundSterling