Russia Abandons PetroDollar By Opening Reserve Fund

2015 has not been good to Russia; the spread between Brent and WTI is gone in anticipation of US exports and both benchmarks have flirted with sub $45 prices. A hostage to such prices, the ruble has yet to begin its turnaround and the state’s finances are in extreme disarray. President Vladimir Putin’s approval ratings remain sky-high, but his country has not faced such difficult times since he took office more than 15 years ago.

Since the turn of the new year the ruble has fallen over 13 percent and Russia’s central bank and finance department are running out of options – to date, policy makers have hiked interest rates to their highest level since the 1998 Russian financial crisis and embarked on a 1 trillion-ruble ($15 billion) bank recapitalization plan to little effect. Their latest, and most dramatic, plan is to abandon the dollar – at least somewhat.

In late December, the Kremlin ordered five large state-owned exporters – including oil and gas giants Rosneft and Gazprom – to sell their foreign currency reserves. Specifically, the companies must bring their foreign reserves to October levels by the beginning of March. To comply, the exporters may have to sell a combined $1 billion per day until March. Private companies have not yet been hit by these soft capital controls, but have instead been advised to manage their foreign exchange maneuvers responsibly.

More recently, the Kremlin announced it will open its $88 billion sovereign wealth fund and flip it for rubles. The plan will see Russia convert as much as $8 billion to rubles (~500 billion) over a two-month span and place them in deposits for banks. Overall, the move will provide the Russian economy with some much needed liquidity and could speed up the healing if oil were to rebound, but it sends the wrong signals to investors and Economy Minister Alexei Ulyukaev believes the country’s credit rating will soon be marked below investment grade.

In any case, the move does little for the country’s ailing oil industry. The domestic market is projected to shrink amid the economic slowdown, and competition for market share abroad is increasingly competitive. Production forecasts are no rosier and the EIA predicts Russian crude production growth will be among the worst performers in both 2015 and 2016 – contrasted by continued growth in North America. Russia’s gas industry has fared no better. Gazprom’s 2014 output was historically awful and LNG is ever more a counter to the country’s pipeline politics.

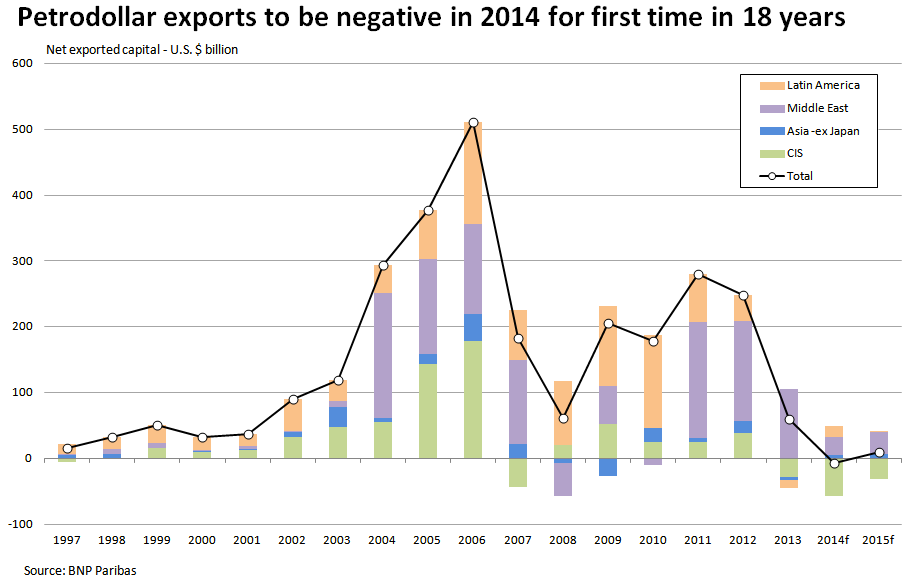

While Russia likely envisioned abandoning its dollars under far better circumstances, the news is just as worrying for the United States and its dollar hegemony. Along with Russia, energy exporters worldwide are pulling their petrodollars out of world financial markets and other USD-denominated assets in favor of greater, and certainly necessary, spending domestically. In the past, these dollars have given life to the loan market and helped fund debt among energy importers, contributing to overall growth.

Petrodollar exports – otherwise known as petrodollar recycling – were negative in 2014 for the first time in nearly two decades. The result is falling global market liquidity, record low US Treasury rates, and higher borrowing costs for everyone – a tough pill to swallow for energy producers if oil prices remain low. The US dollar remains the global reserve currency for now, but the fact remains that nations are increasingly transacting on their own terms, and often times without the USD.

Source: Oil Price – Russia Abandons PetroDollar By Opening Reserve Fund