XXX/JPY Crosses Going Higher as Stocks and Oil Looking BULLISH – Elliott Wave

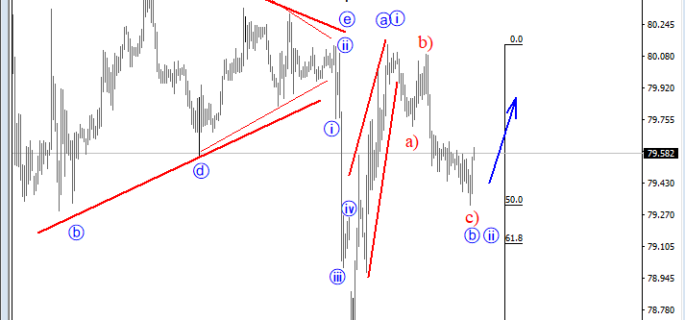

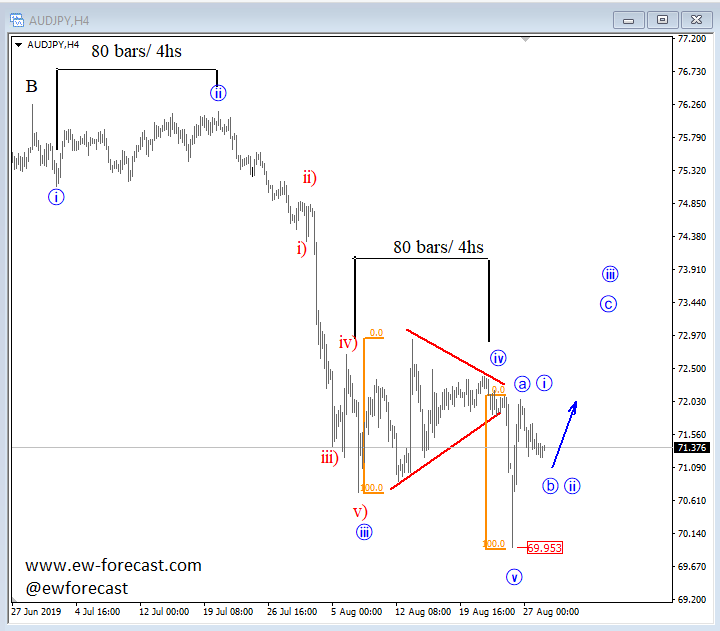

AUDJPY looks to be recovering after a bigger, five-wave drop from end of June, which found a base at the 69.95 level. We know that after a five-wave drop, a three-wave pullback is expected to follow, which means an a-b-c can be now in progress on the pair. On the intra-day chart of AUDJPY we see price in a minor a)-b)-c) pullback of a leg b/ii, after the initial five-wave recovery from the lows labelled as wave a/i. Possible support, and reversal zone for the minor correction can be near the 50.0/61.8 (71.0/70.7 area). Also because of bullish aussie, and bullish stocks, minor wave c/iii rally on the AUDJPY is even more favourable.

AUDJPY, 4h

AUDJPY, 1h

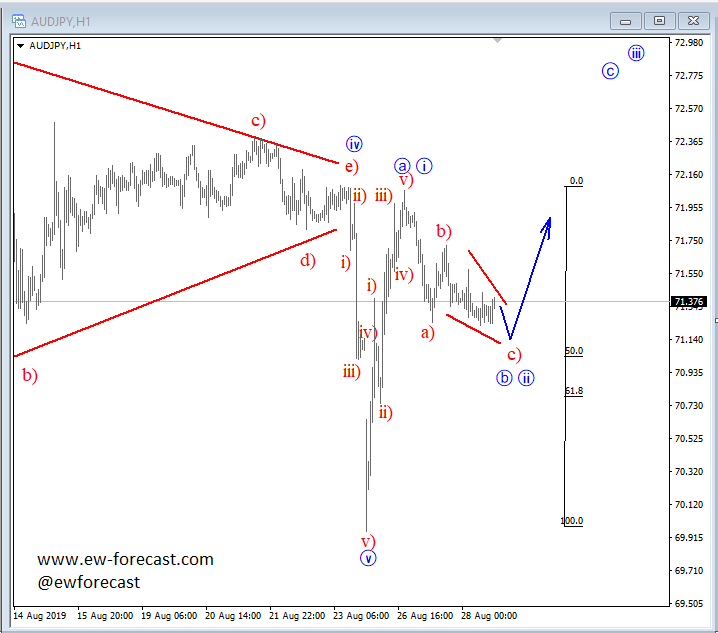

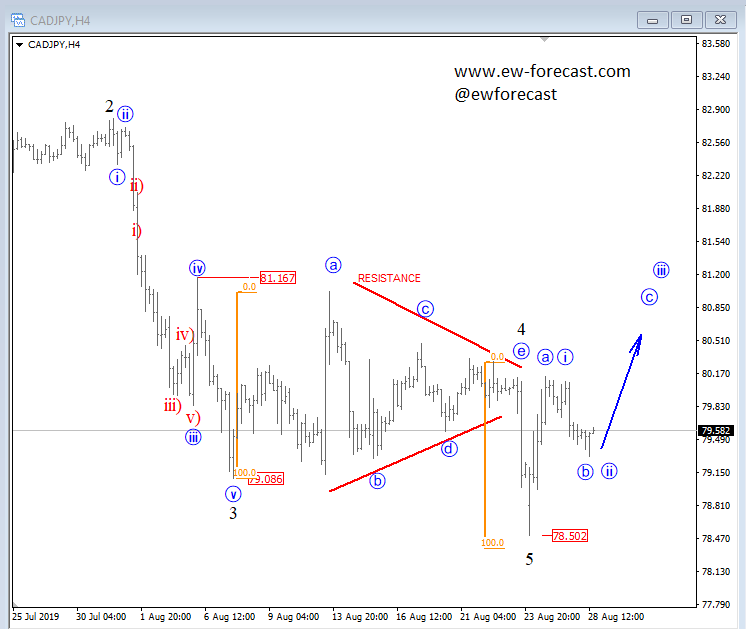

CADJPY made a five-wave drop of a higher degree and found support at the 78.50 area. Like AUDJPY we see price trading into a minimum three-wave recovery a/i-b/ii-c/iii, where corrective wave b/ii is near the Fib. Ratio of 50.0 and 61.8 and turning higher. A rally in impulsive fashion would indicate wave c/iii to already be in progress. Also, because of bullish crude oil, there is a greater chance that cadjpy will go higher.

CADJPY, 4h

CADJPY, 1h

Disclosure: Please be informed that information we provide is NOT trading recommendation or investment advice. All of our work is for educational purposes only.

http://www.ew-forecast.com/service

Find more: Contributing Authors