The global reset scam

This article takes a tilt at increasing speculation about statist global resets, and why plans such as those promoted by the World Economic Forum will fail. Central bank digital currencies will simply run out of time.

Instead, the collapse of unbacked fiat currencies will end all supra-national government solutions to their policy failures. Already, there is mounting evidence of money beginning to flee bank accounts into stocks, commodities and even bitcoin. This is an early warning of a rapidly developing monetary collapse.

Moreover, nothing can now stop the collapse of fiat currencies, and with it schemes to control humanity for the convenience and ambitions of government planners. There can only be one statist solution and that is to mobilise gold reserves to back and save their currencies, which in order to succeed will have to be fully convertible into circulating gold coinage. It will also require the role of governments to be reset into a non-welfare, non-interventionist minimalist role, which can only be achieved after a complete collapse of the current fiat-financed system.

Anything less will fail.

The Deep State and The Blob fuel conspiracy theories

Increasingly, people are beginning to realise that their world is undergoing a period of rapid change, with the future of fiat money now uncertain. For most, it is too difficult to even contemplate. But growing uncertainties are driving wild speculation about what those in authority now have in store for the human race in the form of a global reset. It is a time for conspiracy theorists, aided and abetted by our politicians and central bankers who are being increasingly evasive, because events are spiralling out of their control.

Then there is America’s Deep State, or the British equivalent, the more recently christened Blob; an amorphous entity comprised of the permanent bureaucracy with its own agenda. These faceless planners have moved on from merely making ministers’ lives difficult if they deviate from the blob’s predetermined course — immortalised in “Yes Minister” and its sequel series “Yes Prime Minister”.

As we saw with Brexit, The Blob has been rigging political outcomes, even conniving in elections. Christopher Steele, an ex-MI6 officer produced a dodgy dossier on Trump to influence the American presidential election in 2016. But there is no such thing as an ex-MI6 Agent because of the Official Secrets Act, so we can only conclude that the intelligence arm of The Blob sanctioned it on a distanced basis. MI6 works with other intelligence agencies under the five-eyes agreement and is close to the CIA. Though they do not necessarily share intelligence, it is impossible to conceive of Steele’s role in influencing the outcome of a US presidential election without the CIA’s knowledge. Almost certainly, the fact that it was commissioned must have been with the CIA’s blessing.

At the time of writing, we do not know the outcome of the current presidential election, but enough doubt has been thrown on the validity of the voting process to implicate unknown parties in managing the outcome. It can never be proved, but for increasing numbers of sceptics it looks like a Deep State operation. It is therefore hardly surprising that conspiracies abound.

The World Economic Forum

The most prominent of these conspiracies has hit the headlines in recent weeks. Its ambition is to take the lead in resetting the world by dismantling the capitalist system in favour of a greater technocratic rule — a fourth industrial revolution no less, even planting microchips in humans to read their brains and control them. The leader is one Klaus Schwab, whose World Economic Forum runs the annual Davos bunfight.

As leader of the Davos forum, Schwab probably sees himself as the coordinator of world government. If so, at 82 years old he is probably getting impatient about the progress towards his personal vision of ultimate power. The covid chaos and the success of his climate change agenda must be encouraging him to think he is very close to a breakthrough. Alternatively, we might consider Schwab as a latter-day Charles Fourier (1772—1837), the utopian socialist philosopher, whose forgotten ideals were only marginally more narcissistic and bizarre than Schwab’s.

While the great and the not so good love the annual Davos party as a networking venue for the politics industry, when it comes to transferring real power to Schwab, it’s a no-no. The only time a politician transfers power is when he is deposed by his or her electorate, colleagues, or the military. And history is littered with utopians, like Schwab, grasping for power over their fellow men. In addition to Charles Fourier, we can include Georg Hegel (1770—1831) and Auguste Comte (1798—1857), as well, of course, as Karl Marx. As thinkers or philosophers, they were all influential in their day and some of their ideas persist in the naïve.

So, while increasing numbers of well-informed people are beginning to sense the end of the current world order, to assume that this will hasten the WEF’s grab for world domination by influencing events is a mistake. All our deep states, blobs and their branches, particularly central banks, will want to hold onto and enhance their executive power with the political class increasingly cast as cover. The planners at national level are not going to submit to Mr Schwab’s plans for world domination. Instead, international relations involve mutual cooperation to secure purely domestic objectives, something President Trump was in the process of destroying. From the Deep State’s point of view, perhaps that’s why he had to be deposed in favour of Biden, who is a long-serving compliant figure.

Central bank digital currencies (CBDCs)

There can be little doubt that central banks wish to increase their control over money and how it is used, cutting out the obstacle of commercial banks who produce most of the money in circulation through the expansion of bank credit. From a statist point of view, commercial banking is a dinosaur, an outdated remnant of free markets, perpetuating needless systemic risk and superseded by technology. Branch networks will disappear with cash, changing relationships between banks and the general public for ever.

By introducing direct central bank accounts for members of the public and every business, commercial banks become superfluous and can be allowed to die. And if one goes bust before commercial banking has ended, the facility to transfer all its loans and deposits onto a central bank’s books will then exist. The removal of systemic risk by the abolition of commercial banks is one of several likely long-term objectives of CBDCs. Commercial banks can be left with the role of investment banking activities in capital markets.

We can imagine the development of CBDCs going even further than just replacing cash. Stimulation by dropping money into personal accounts can be used to target increased spending by consumers, or even groups of consumers, sorted by wealth, location or other factors. Some consumers can be favoured relative to others, so in a swing state, for example, an incumbent administration might buy votes. While this would be strongly denied, as we have seen with unfettered fiat currency the state creeps incrementally towards unstated objectives, using every tool at its disposal. The election of Deep State-approved politicians then becomes possible.

Eventually, funding of all capital projects will come under the direct control of the central bank. And savings deposits, always seen to be a brake on consumption, can be banished. Capital can be made available for government schemes and favoured businesses on the say so of the central bank.

A future government statement might be issued on the following lines:

“Your Government is pleased to announce that the National Audit Office has approved a number of infrastructure projects targeted at improving communications between administrative centres. This investment over ten years will secure an estimated 500,000 jobs. The cost over the life of the project is XXX billion monetary units. The Central Bank has confirmed it will make funding for these projects available, both to your Government and approved private sector contractors.”

This would be a planners’ heaven. Furthermore, CBDC money can be withheld or frozen for anyone suspected of crimes and tax evasion, starving them into confessions of guilt. The justification is always that it is in the national interest to ensure that financial and tax crimes are eliminated — something commercial banks have singularly failed to do. Overseas payments can be routed through other CBDCs, giving the central banking network control over world trade. Just imagine foreign trade being conducted through a grander version of the Eurozone’s TARGET2 settlement system!

Worried yet? In the advanced economies Covid-19 has nearly eliminated cash, which doubtless is intended to be replaced entirely by CBDCs. The end of cash and bank deposits will allow the central bank to cap the amount of cash anyone can hold, and also ensure that everyone is paid a “living wage”. Already flagged, another intention is to eliminate the burden of interest rates and by controlling where money supply is expanded, manage the economy.

It is commonly assumed that those in charge of us know what they are doing — they don’t. They have become trapped at a socialist endpoint and are doubling down in their efforts towards greater socialism. But their dreams of future control are mere escapism. Individuals will lose yet more personal freedom, but ultimately the state cannot conquer human nature and the will of individuals to do what they want. The Soviets attempted it and failed, despite killing and starving many millions.

Central to the collapse of any state-directed reset will be the loss of faith in fiat currencies, and particularly that of the world’s reserve currency, the US dollar. This remains the case irrespective of whether circulating currency is in cash, bank deposits, or CBDCs. Indeed, the collapse could be hastened by CBDCs, because the intention is to increase the pace of injection of new money into the economy if it is required (it always is), and to impose deeper negative interest rates, which cannot be easily achieved under the current monetary system.

If these statist intentions are allowed to prevail, along with other agendas such as the elimination of cheap and effective fossil-based energy, the outlook for humanity is exceedingly grim. Like communism, the global reset into which the western world is drifting will destroy society. Those who believe in liberal values in the original sense of the term — not the modern socialist connotation — will find themselves welcoming the destruction of the current system before it is evolved any further.

The course of a currency collapse

The end of fiat currencies is likely to come sooner than later, from the consequences of today’s massive money-printing, particularly of dollars. Already, US government spending is financed substantially more by currency debasement than taxes, a condition that will almost certainly continue to deteriorate rapidly in the coming months. Furthermore, the global banking system, which is extremely thinly capitalised, faces a tsunami of bad debts which can only lead to a systemic failure — most likely in the Eurozone initially, but threatening all other jurisdictions through counterparty risks. It is coming to a head and is likely to happen soon, possibly triggered by the second covid wave.

Long before the two or three years required for any CBDC to be operational, the world’s reserve fiat currency, the US dollar, is already hyper-inflating. There are signs the markets are beginning to understand this. Bitcoin’s price has risen sharply, sending signals to everyone that the differential between its ultimately fixed quantity and the accelerating rates of fiat currency debasement is feeding dramatically into the price.

Despite the economic slump, equity markets are being driven to new highs as non-financial customers deem stocks to be preferable to bank deposits. It has not helped that the Fed reduced deposit rates to zero last March, well below everyone’s time preference. The Fed has also promised infinite QE in order to fund the fiscal deficit. Therefore, it is not surprising that individuals and corporations are shifting out of cash balances into financial and other assets, with the notable exception of fixed-interest bonds. Rising commodity and raw material prices are also telling us that dollars are been sold in those markets.

This is the point being missed in all commentaries: the mounting evidence that markets, being forward-looking, are beginning to abandon the dollar. And once it goes beyond a certain point, nothing will reverse a rapid loss of purchasing power to the point of worthlessness. To avoid this outcome central banks led by the Fed must immediately abandon inflationary financing of budget deficits.

That is not going to happen. In addition to the current hyperinflation must be added the inflationary cover for the costs and consequences of rescuing a failing global banking system. The costs are immediate, in that governments will take on their books everyone’s bad debts. The consequences are that through their central banks they will have no political alternative other than to counter the economic slump through yet more money printing.

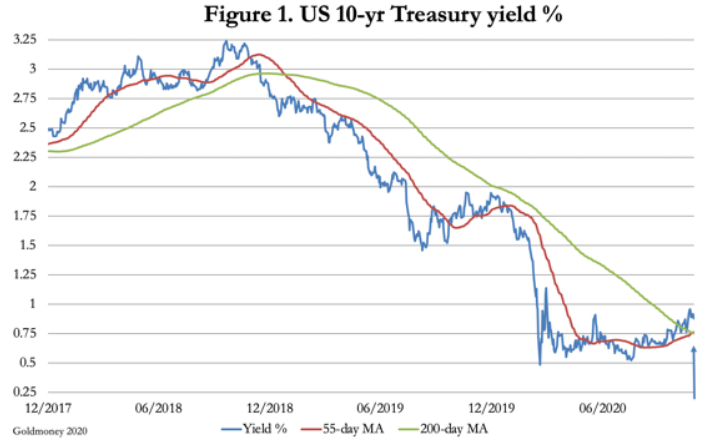

US Treasury bond yields are already beginning to rise, perhaps reflecting this developing outcome as Figure 1 shows.

The up-arrow at the bottom-right of the chart shows that the downward momentum for the bond yield has reversed, forming a golden cross; that is to say the yield is above its two commonly followed moving averages which in turn are forming a cross with the 55-day moving average rising above the 200-day moving average, a strong indicator of a major turning point and of higher bond yields to come. The upward turn of bond yields is to be viewed in the context of the dollar’s trade weighted index, which is shown in Figure 2.

Currently standing at 92.40, if the dollar’s TWI breaks below 91.75 (the low on 1 September) it is likely to head significantly lower. With foreign holdings of dollars and dollar denominated financial securities totalling almost $27 trillion, the chances are that dumping of the dollar on the foreign exchanges will increase rapidly. That being the case, the Fed will not only be funding the unprecedentedly high (for peacetime) budget deficit but will have to absorb foreign sales of US Treasuries and dollars in order to keep the cost of government funding suppressed.

Evidence is mounting that it cannot be done. And with the end of the suppression of interest rates comes the collapse of accumulated malinvestments, of government finances, and of the currency itself.

First the ashes, then, hopefully the phoenix

Elected in 1929, Hoover was the first US President who thought he could improve on the capitalist system of markets reforming themselves, and the results were a disaster. He was thrown out of office and replaced with another interventionist, Roosevelt, and the supremacy of the US Government over markets reforming themselves became established. The situation today is the logical destination of the fallacy that governments can run the economy.

It will end with the collapse and replacement of today’s unbacked fiat currencies — the ashes and then the phoenix. There is every indication that the time when all is rendered into ashes is rapidly approaching. People with fiat, earning fiat, relying on fiat will be impoverished. A currency collapse with no foreign currency to escape into is a cataclysmic event, the like of which we haven’t seen before, not even in Roman times. If it doesn’t buy you food and warmth a million bucks is worthless.

Governments will also have no means of collecting taxes, other than in their worthless currencies. They will be unable to pay their administrators, who cannot even afford to attend their offices. Their pensions and everybody else’s will be worthless. There will be no incentive for anyone in government without money. And without money there is no political power.

There can only be one solution, and that is a reset with gold. The slide in currencies can be stopped by making them exchangeable into gold. The reason for a gold-backed reset is not so much to stop a fiat currency from further collapse but to use it to ensure the widest distribution of the national gold reserves through a reformed gold-backed currency. The US Treasury claims it still has over 8,000 tonnes of gold, which assuming the Deep State hasn’t raided it, can ensure that a new dollar, convertible by everyone into gold, can circulate as money.

The same is true for other currencies, to greater or lesser degrees depending on their national gold reserves. But to be credible, gold coins must also circulate freely alongside readily convertible paper and digital substitutes. The banking system must also be reformed to do away with bank credit expansion, which creates deposits unbacked by gold. By then most of them may be in public ownership or protection, so a reform to abolish bank credit expansion should not be too difficult.

The mobilisation of central bank gold is the best outcome by far. It returns the choice of money to the people who use it for the intermediation between their production and consumption. But very few in government, their Deep States or The Blobs, have the intellectual capacity to understand what needs to be done. Their advisors are inflationists to a man or woman. Furthermore, the US’s Deep State is obsessed with the threat from China and Russia, which between them control international bullion markets (London and Comex are just paper), and have substantial declared and undeclared reserves. Legitimising gold will transfer enormous monetary and geopolitical power from America to the Asian hegemons, which is likely to be strongly resisted.

Furthermore, it will require governments to backtrack on the socialising process, whereby by providing welfare and regulating everything their budgets got out of hand. They must aim to reduce the full burden of their activities on the economy to under 20%.

Following a currency collapse, any central bank that thinks it can use a CBDC to manage market outcomes will undermine its own credibility. Other than issuers of gold-backed notes, they will have no role. in order for the necessary reforms to stick, flights of fancy such as the statist ambitions of planners and of the Klaus Schwabs of this world must be abandoned, along with all the false sciences adopted by statists. But on the positive side, a collapse of fiat currencies is required to sweep away the current failing system, and sooner or later that is what we are going to get.

By Alasdair Macleod, www.goldmoney.com

Find more: Contributing Authors