Largest independent broker-dealers enjoy double-digit revenue growth

Despite lackluster sales of commission-rich products, IBD revenues grew in line with the broad market in 2014

Despite lackluster sales in 2014 of commission-rich products such as variable annuities and nontraded REITs, the leading independent broker-dealers managed to squeeze out double-digit revenue growth in line with the broad market.

The 25 largest independent broker-dealers recorded a 10.3% year-over-year increase in revenue, reporting $20.4 billion last year versus $18.5 billion in 2013, according to the latest InvestmentNews survey.

The industry’s growth in 2014 fell a bit short of returns of the S&P 500 index, which posted a total annual return of 13.69%.

Independent broker-dealer executives said they were pleased with 2014 results, although last year’s performance slipped from 2013, when the 25 largest IBDs recorded a 13.2% year-over-year increase in revenue.

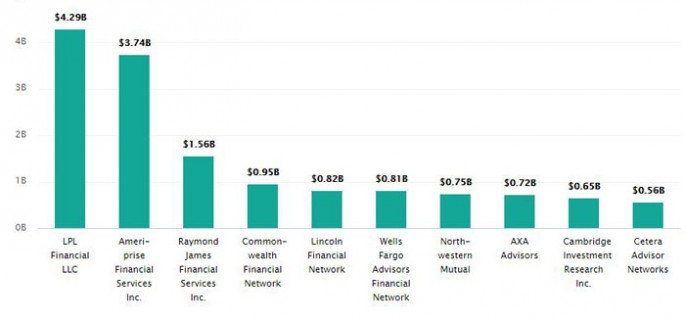

The top 25 firms ranged from LPL Financial at No. 1, with $4.3 billion in total revenue, to Cetera Advisorsat No. 25 with $293.9 million. A sister firm, Cetera Advisor Networks, saw annual revenue of $564.8 million for an eye-popping year-over-year increase of 29.6%, the best annual rate of growth among the top 25. That was good enough to move the firm up to 10th from 12th in InvestmentNews’ revenue ranking. (Part of the increase in revenue was the result of bringing over advisers in early 2014 from broker-dealers Cetera had acquired from MetLife Inc.)

Twenty-one of the top 25 IBDs that reported revenue for sales of alternative investments suffered a year-over-year slump. The declines, which averaged 15%, came after particularly strong sales in 2013 of nontraded real estate investment trusts and other alternatives, brokerage executives noted. Sales of variable annuities, another high-commission product, were tepid, increasing a mere 3.4% last year.

Top independent broker-dealers ranked by 2014 total revenue

Commissions grew only 5% last year, but were offset by an increasing reliance on fees. On average, revenue from investment products and services that charge a fee rather than a commission increased 20% in 2014 for the top 25 IBDs, reflecting the long-term trend in the financial services industry.

POTENTIAL CONCERNS

While industry executives were optimistic about growth in 2015, they also pointed to potential concerns. Those include the recently released Department of Labor “definition of fiduciary,” which could have an impact on the way broker-dealers do business with small retirement plans and individual retirement accounts. Another concern is the potential impact on sales of nontraded REITs from industry rules scheduled to take effect next April that impose new requirements for reporting estimated share values on client account statements.

“Last year’s performance was due to a combination of a slowdown in sales of alternative investments, namely nontraded REITs, and the stock market not being as robust as it had been in 2013,” when the S&P 500 posted a 32.4% return, including dividends, said Eric Schwartz, chief executive of Cambridge Investment Research Inc. “The market was up but not in a way to inspire people to throw money into it.”

“We had an extra high level of alternative sales, primarily nontraded REITs and business development companies, in 2013 because of a sizable bunch of liquidity events that caused a rollover of client money back into those advisers’ practices,” said Richard Lampen, CEO of Ladenburg Thalmann Financial Services, which owns four IBDs. “With variable annuities, there was sales growth last year but it was modest. What’s offsetting that is a huge flood of assets that the industry’s top firms are gaining through market appreciation and recruiting.”

Figuring out the impact of the DOL’s fiduciary rule will be at the top of many IBD executives’ minds this year.

“It’s incredibly complex and significantly different from the rule proposal in 2010,” said Adam Antoniades, president of Cetera Financial Group, an umbrella group of 11 IBDs owned by RCS Capital Corp. “It looks to promote client engagement that serves the best interest of clients. We, like the industry, applaud those efforts. The risk is unintended consequences. My guess is this will drive fee-based business.”

Sensitive to moves in interest rates, variable annuity sales suffered particularly in the second half of last year as the yield on 10-year Treasury notes declined closer to 2%, noted Dan Arnold, president of LPL Financial. On July 1, the yield on 10-year U.S. Treasury notes was 2.58%. By the end of the year, it had dropped 16% to 2.17%.

“That was a challenge to annuity sales,” Mr. Arnold said. “There’s a head wind with annuities until the yield on the 10-year Treasury moves up.”

“With variable annuities, the contracts are more expensive and the riders are less attractive,” said John Rooney, a managing principal of Commonwealth Financial Network. “It’s more difficult for advisers to do 1035 [variable annuity] exchanges, and the new business is not as attractive.”

SLOW START

A return to the heady level of commissions generated in 2013 from sales of nontraded REITs looks unlikely this year, industry executives noted. Already, the year is off to a slow start for nontraded REIT sales. According to investment bank Robert A. Stanger & Co. Inc., total equity raised over the first quarter of 2015 is almost $900 million, or just 21.5% of the $4.2 billion raised in the same period in 2014.

Working against sales of nontraded REITs is the fear of rising interest rates, which can hurt the performance of some real estate investments, particularly the popular net lease REITs, as well as continued questions about Cole Capital.

Just two years ago, Cole was one of the leading sponsors of net lease nontraded REITs. But sales of Cole-branded products have practically come to a halt since the end of October, when its parent company, American Realty Capital Properties Inc., revealed a $23 million accounting error in the first half of 2014 that was intentionally left uncorrected.

Regardless, firms will continue to focus on new initiatives and expand lines of business for advisers working with clients. The AIG Advisor Group, for example, is launching a new enterprise general agency to sell fixed insurance from a handful of carriers, said CEO Erica McGinnis.

“Only 4% of revenue comes from fixed insurance. It’s low everywhere,” she said. “We want advisers to not shy away from fixed insurance, whether it’s term or whole life or fixed universal. It’s an important part of the planning process. Many of our advisers aren’t doing insurance and referring it down the street. They have a strange apprehension about talking to clients about needing to lose 20 pounds and stop smoking.”

Source: investmentnews – Largest independent broker-dealers enjoy double-digit revenue growth