Shares Jump From Europe to Japan as Oil Holds Rally; Yuan Soars

-

Absence of post-holiday China selloff bolstered sentiment

-

Draghi said ECB will act should turmoil hit price stability

Stocks came back with a vengeance amid speculation losses that sent global equities into a bear market had gone too far, with rallies in crude oil and the Chinese yuan burnishing sentiment.

Shares in Europe capped their biggest two-day gain in more than four years and Japan’s Topix index soared the most since 2008, with markets in North America closed for a holiday. Developing-nation equities rebounded from their worst weekly drop in a month, as oil built on Friday’s surge. The yuan strengthened the most since a dollar peg was scrapped in 2005 after People’s Bank of China Governor Zhou Xiaochuan talked up the credentials of the world’s second-largest economy. Demand for haven assets such as gold and the yen waned, while nickel climbed the most in two months amid the yuan rally.

Chinese markets returned Monday from a week-long holiday, during which a gauge of global stocks capped a 20 percent slide from its May record and anxiety over the ability of central banks to quell the volatility intensified. Governor Zhou front-footed the market, making rare comments at the weekend on the health of the Chinese economy and asserting the stability of the local currency. Shanghai shares pared a drop of 3 percent, even as China reported a record trade surplus amid slumping imports and exports.

“The Chinese market didn’t react as bad as we feared and with the weak export data there is some big hope that the central banks will react quite fast,” said John Plassard, senior equity-sales trader at Mirabaud Securities LLP in Geneva. “It’s a mix of hope of intervention from the Asian central bank, short squeeze and also a relief in some energy and banking sectors, the most shorted sectors.”

Stocks

The Stoxx Europe 600 Index rose 3 percent, extending Friday’s climb as European Central Bank President Mario Draghi reiterated that policy makers would act should financial turmoil threatened price stability during testimony to the euro region’s parliament.

Benchmark stock indexes of Italy, Spain and Germany rallied more than 2.6 percent after all having lost more than 16 percent this year through Friday, the world’s worst performers among 93 equity indexes tracked by Bloomberg.

Italian and Greek lenders led the rally, with Credit Suisse Group AG climbing 2.7 percent, after hitting record lows last week. HSBC Holdings Plc rose on plans to keep its headquarters in the U.K. after considering a relocation to Hong Kong. A weaker euro helped a gauge of European automakers post the steepest gains of the 19 industry groups on the Stoxx 600, with PSA Peugeot Citroen and Valeo SA rising at least 5.7 percent.

Futures on the Standard & Poor’s 500 Index climbed 1.5 percent as of 4 p.m. in New York, with ordinary markets closed for the Presidents Day holiday.

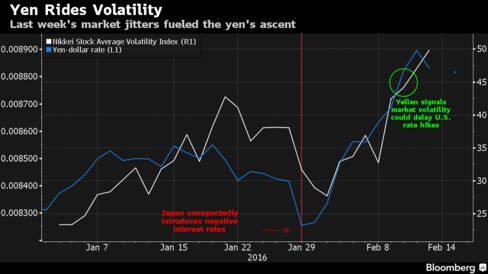

The MSCI Asia Pacific Index jumped the most in 5 months, with the Topix soaring 8 percent for its six-highest gain on record. The stock gauge slumped 13 percent last week, its worst weekly loss since 2008 as the yen rallied despite the Bank of Japan’s unexpected move into negative rates last month.

Currencies

The yuan climbed 1.2 percent from its Feb. 5 close to 6.4940 per dollar in Shanghai.

Zhou said China’s balance of payments is good and capital outflows are normal, with the exchange rate basically stable against a basket of other currencies, according to aninterview published Saturday in Caixin magazine. The remarks marked an escalation in verbal support for Chinese markets, with Zhou having left most of the commentary over the past few months to deputies.

The yen retreated 1.2 percent to 114.58 per dollar, trimming this month’s advance to 5.7 percent. Japan’s gross domestic product shrank an annualized 1.4 percent in the three months ended Dec. 31, following a revised 1.3 percent gain in the third quarter, official data showed Monday.

The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, rose 0.5 percent as more positive sentiment dimmed the appeal of haven currencies like the yen and the Swiss franc. The index has lost 0.6 percent this year as the case for further U.S. rate hikes in 2016 dims.

There’s about a 36 percent chance the Fed will raise interest rates in 2016, according to futures data compiled by Bloomberg. The odds were more than 90 percent at the end of 2015, before anxiety over the global economic outlook, China’s slowdown and the selloff in crude oil took hold.

Bonds

Portuguese bonds, which suffered the brunt of the selloff in riskier assets last week together with debt of Greece, advanced for a second day.

Portugal’s 10-year bond yields fell 21 basis points, or 0.21 percentage point, to 3.48 percent, while Spain’s 10-year rates dropped four basis points to 1.69 percent, leaving the spread to similar-maturity German bunds at 146 basis points. The gap swelled to 170 basis points on Feb. 11.

The cost of insuring corporate debt tumbled for a second day. The Markit iTraxx Europe Index of credit-default swaps on investment-grade companies dropped four basis points to 115 basis points, while a measure of swaps on junk-rated businesses fell 12 basis points to 450 basis points. Indexes tied to swaps on financial companies’ senior and subordinated debt also dropped, largely erasing last week’s increases.

Commodities

West Texas Intermediate crude rose 1.1 percent to $29.76 a barrel in electronic trading, after earlier sliding as much as 1.7 percent. The futures soared 12 percent on Friday amid a rebound in U.S. and European equities.

Iran loaded its first cargo of oil to Europe since international sanctions ended, while Chinese crude imports in January fell almost 20 percent from a record in the previous month, easing concern over the global glut.

Copper gained 1.4 percent in London after the PBOC governor’s comments, while nickel jumped almost 6 percent.

Gold for immediate delivery, regarded as a safe investment along with government debt and the yen, slipped 2.3 percent to $1,209.30 an ounce after jumping 5.5 percent last week, its biggest weekly gain since 2011.

Emerging Markets

The MSCI Emerging Markets Index added 2.2 percent amid gains in stock markets from South Korea to eastern Europe.

The Hang Seng China Enterprises Index of mainland Chinese equities listed in Hong Kong jumped 4.8 percent, its steepest advance since September and rallying from a six-year low. Equity gauges in mainland China and Vietnam retreated as those markets returned from the week-long Lunar New Year holiday.

The Malaysian ringgit, Russian ruble and Chilean peso gained at least 0.4 percent, as a gauge of developing-nation currencies added 0.3 percent, reversing some of a 0.4 percent drop from last week.

Turkey’s lira slipped 0.6 percent on reports of fighting between Turkey and Syrian Kurdish militia over the weekend. Prime Minister Ahmet Davutoglu said Saturday that Turkey had returned shellfire by YPG, Syrian Kurdish fighters who are classified by Turkey as terrorists.

Source: Bloomberg

No matter if some one searches for his required thing,

so he/she wants to be available that in detail, therefore that thing is maintained over here.