Aussie, Kiwi Sink on Rate-Cut Bets as Asia ex-Japan Stocks Fall

-

S&P 500 futures slip as crude oil drops to about $45 a barrel

-

Yen advances with U.S. Treasuries as ringgit weakens

The Australian and New Zealand dollars dropped by the most this month as speculation mounted that their central banks will cut interest rates as soon as next month. Asian stocks outside of Japan retreated with oil as haven assets including the yen and U.S. Treasuries rose.

The Aussie retreated from near a two-month high reached Friday as the Reserve Bank of Australia said the jobs market was losing momentum amid weak inflation. The kiwi lost ground against all 31 major peers after Reserve Bank of New Zealand moved to rein in the nation’s housing boom, an obstacle to lowering borrowing costs. The MSCI Asia Pacific excluding Japan Index snapped a six-day winning streak as crude slipped to about $45 a barrel. Shares in Tokyo advanced as trading resumed after a holiday, while the yield on 10-year U.S. government debt fell from this month’s high.

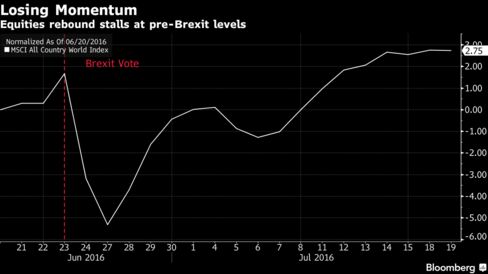

Policy makers are under pressure to unleash stimulus as the global economic outlook shows signs of worsening. The International Monetary Fund is due to update its projections for world growth on Tuesday and Managing Director Christine Lagarde warned last week that estimates may be cut. Nonetheless, global equities have recovered to above where they were at the time of the U.K.’s vote to leave the European Union and the U.S. earnings season has so far delivered more positive surprises than negative ones.

“The market is taking a pause,” said Tony Farnham, a strategist at Paterson Securities in Sydney. “There isn’t much of a catalyst out there. People are starting to question if there’s still value in the market following the post-Brexit rally.”

U.S. data on Tuesday are forecast to show housing starts were little changed in June from the previous month, while companies due to report quarterly results include Goldman Sachs Group Inc., Microsoft Corp. and Johnson & Johnson. Turkey’s central bank is seen lowering its overnight lending rate by a quarter of a percentage point at its first policy review since a failed coup over the weekend. Economists were predicting a half-point reduction prior to the attempted takeover by some of the military, a Bloomberg survey showed.

Currencies

The Aussie slipped 0.9 percent to 75.25 U.S. cents as of 1:48 p.m. Tokyo time, after strengthening in each of the last seven weeks. Minutes published Tuesday from the RBA’s July 5 policy meeting showed that the central bank estimated the economy to have slowed last quarter and policy makers were concerned about currency appreciation. The likelihood of an August rate cut has increased to 56 percent from 45 percent over the past week, derivatives indicate.

New Zealand’s dollar dropped 1.1 percent. The central bank said it will require property investors buying housing in the nation to have a deposit of at least 40 percent from Sept. 1, compared with an existing requirement that such buyers in Auckland have at least a 30 percent deposit. Swaps traders are pricing in a 78 percent chance of an RBNZ rate cut on Aug. 11, compared with 39 percent a week ago.

The yen strengthened 0.4 percent to 105.78 versus the greenback, after sliding 1.2 percent in the last session. It was trading at about 106 prior before the outcome of the Brexit vote. The currency tumbled 4.1 percent last week as Japanese Prime Minister Shinzo Abe outlined plans for a “bold”stimulus package in the wake of an election victory.

South Africa’s rand and Malaysia’s ringgit led losses among emerging-market currencies, weakening by 0.3 percent. China’s yuan was the best performer with a 0.1 percent gain.

Stocks

The MSCI Asia Pacific excluding Japan Index fell 0.5 percent as benchmarks declined in Hong Kong, Shanghai and South Korea. Japan’s Topix index rose 0.6 percent from Friday’s close, buoyed by Monday’s slide in the yen. SoftBank Group Corp. tumbled 10 percent, its biggest loss since 2012, after agreeing to pay $32 billion for ARM Holdings Plc.

Futures on the S&P 500 Index declined 0.1 percent, after the gauge closed at a record high. Contracts on the U.K.’s FTSE 100 Index fell 0.4 percent.

“On current sentiment it seems likely that any pullbacks will be shallow and a buying opportunity,” said Chris Weston, chief market strategist at IG Ltd. in Melbourne. “We will need to see good earnings, or the market is at risk of rolling over.”

Commodities

Crude oil retreated 0.4 percent to $45.05 a barrel in New York. It slid 1.6 percent on Monday after a failed coup attempt in Turkey failed to disrupt shipments through the country, a vital conduit for moving from Russia and Iraq to the Mediterranean Sea.

Gold held near a two-week low, while copper declined 0.3 percent in London.

Bonds

U.S. Treasuries due in a decade rose for the first time in four days, pushing their yield down by three basis points to 1.55 percent. The yield reached 1.60 percent in the last session, the highest it’s been since June 24, when the Brexit vote count was announced. Morgan Stanley predicts the rate will sink to 1 percent in the first quarter of 2017, lower than any of the 61 estimates in a Bloomberg survey.

Similar-maturity bonds in Australia also advanced, cutting their yield by six basis points to 1.94 percent. New Zealand’s yield fell seven basis points to 2.28 percent.

The cost of protecting Asian bonds against default using credit-default swaps dropped to an 11-month low, according to Markit iTraxx Asia index prices compiled by Australia & New Zealand Banking Group Ltd. and data provider CMA.

Source: Bloomberg