Even Hedge Funds Can’t Understand Today’s Manipulated Markets

One of the big surprises of the past few years is the number of brand-name hedge funds reporting terrible results. Their customers are not amused:

Hedge Funds Are Losing Endowments After Exodus of Pensions

(Bloomberg) – Following the lead of pensions, some U.S. endowments and foundations are souring on hedge funds.

Hedge fund fees and lagging performance are cause for concern for nonprofit investors, who are reducing their allocation, according to a survey published Monday by NEPC, a Boston-based consulting firm with 118 endowment and foundation clients with assets of $57 billion.

More than a quarter of 59 respondents said their investment committees reduced or were considering lowering their allocations to hedge funds. Of those that made changes, almost half said they put that money into public equities. NEPC conducted the survey in July, polling business officers of universities, foundations and other nonprofits on their market outlook and asset allocation. About one-third of the respondents were universities.

“The last several years have been difficult for the industry and investors are starting to look very closely at how hedge funds can work for them,” Cathy Konicki, who oversees the company’s endowment and foundation business, said in a statement.

This month, the New Jersey Investment Council voted to cut its $9 billion hedge fund portfolio in half. Endowments and foundations are struggling with returns, and most are expecting losses for the year that ended in June. The survey indicates other institutional investors are following similar strategies to some pension funds, as a quarter of respondents said they had no exposure to hedge funds in their portfolio. Only 2 percent of those surveyed two years ago had no hedge funds.

“These survey results are by no means indicating a mass exodus from hedge funds, but they do point to greater pressure being felt by the industry as a whole,” Konicki said.

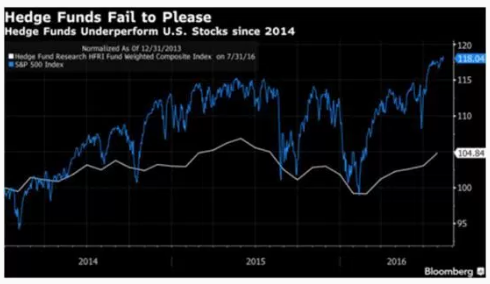

Hedge funds typically charge a 2 percent management fee and 20 percent of profits. The industry, extending its rebound from the worst start to a year on record, posted an average 1.3 percent return this year through July, according to Hedge Fund Research Inc., while the S&P 500 Index gained 7.7 percent in that span.

A quarter of survey respondents said they have asked for reduced fees or have been offered them by managers within the last six months.

Why are hedge funds underperforming generic stocks and bonds? Because governments are now manipulating those markets, and doing so indiscriminately. Japan’s central bank, for instance, is now the biggest holder of most domestic ETFs and a lengthening list of individual equities. But its buying isn’t based on actual analysis; it simply acquires a cross section of major securities. This pushes all prices up simultaneously, giving the market a broad-based rally.

Since hedge funds get paid to find special situations that will outperform the broad averages (known as “generating alpha”), when government intervention levitates the household names that dominate the broad averages it tends to leave the more obscure special situations and related strategies behind. So hedge funds end up underperforming, and fail to justify their aggressive fees. And customers respond by pulling money out of hedge funds hedge funds in favor of passive instruments like ETFs which seem to nenefit from indiscriminate government buying.

It’s fun to see arrogant hedge fund managers joining the “unprotected” class, but it’s also deeply disturbing to see formerly semi-free markets be distorted to the point that even the icons of the investing world can’t understand them.

You can bet that entrepreneurs trying to decide whether and where to build factories and hire new people have no better handle on these markets than do hedge fund managers. The result: massive malinvestment and an epic financial crisis. Or a world in which governments own everything of value and dictate terms to the rest of us. Which, readers of a certain age will recall, was tried in most of the world during the 20th century, with less than optimal results.

By John Rubino, http://dollarcollapse.com/

Find more: Contributing Authors