GBP Is A Bad Apple While Dollar Is Squeezed

Not the ideal start to a week where many expected more enthusiasms being expressed across the various asset classes, especially after last week’s stronger US employment headline print. Maybe the market is priming itself for the summer doldrums? The global equities excuse is that investors prefer to assess equity valuations ahead of earnings reports. Too many investors think it’s a tad rich at record highs to consider jumping in with both feet. The forex contingent continues to live off scraps, with the 18-member single unit being squeezed mostly on the crosses rather than outright. Today the EUR happens to get a small lift from an ‘old foe,’ the UK, who’s headline economic releases have managed to push the pound to different heights, something that certainly was not expected.

GBP burned by production

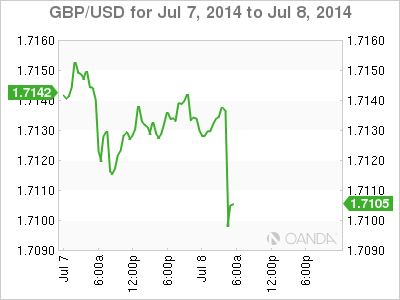

The pound has encountered some weakness (£1.7099) after this morning’s UK May manufacturing output registered its largest monthly decline (-1.3%) since January 2013. The wider measure of industrial production fell -0.7% in the same month. On the year, UK IP has grown +2.3% and has also grown for nine-consecutive months. The fall in output was across the board and could raise concerns that the UK economy may only be a “one trick pony” where the UK economy outside of housing is not as “vigorous and thus more negatively impacted by a tightening cycle.” This disappointing output print has probably added some dovishness to potential BoE rate hike expectations.

Obviously Sterling has taken a hard hit, falling so far to a one-week low of £1.7090 from £1.7140. This is certainly a blow for the ‘hawks’ – mostly advocating a UK rate hike before year-end. Any downward momentum from this side of the pond this morning by ‘long’ sterling positions booking profits has the potential of pushing the pound towards that psychological £1.7000 handle where decent interest to own the pound remains. Exiting GBP positions is subtly lending support to the EUR. It has already pushed EUR/GBP to a fresh day high of €0.7961. The techies do not see much resistance until the €0.8000 handle.

ECB Ready to act

The EUR has mostly been confined to a +200-pip range for the past six-weeks and is currently hovering just under the €1.3600 handle again. ECB members are out in force today (Lautenschlaeger, Noyer and Linde), reiterating forward guidance and preparing the markets for any ABS purchases if needed. Low and declining inflation remains the main challenge in Europe. The ECB is “ready to take any actions that may prove necessary should downside risks further materialize.” It’s all the same rhetoric, just a few different faces on a different day.

It not a surprise to see UK Gilts take flight after such weak industrial and manufacturing data this morning. The market was at the beginning of pricing a BoE rate hike much sooner than previously expected. Some dealers were beginning to shift their time horizon from early next year to the end of this year, so there is a bit of unwinding to be done in the short end. Gilts are also outperforming Bunds as the latter stands still, tightening the 10-year spread in to +145.8bp from +147.5. With the Euribor completely uninterested, 10-year periphery/Germany is wider again today, and keeping this months widening trend intact. It seems that both Spain and Italy have tapped out for the time being.

‘Carry’ Loves Kiwi

Before Sterling succeeded in hogging the headlines, the Kiwi managed to dominate most of the action during Australasia trading. The NZD (0.8785) got a boost from Fitch rating agency, testing above $0.8800 -it’s highest level since Aug 2011- after they raised New Zealand’s credit rating outlook to positive from stable. Certainly lofty heights, however, along with the AUD there is a good market appetite for the ‘carry’ trade. These “carry” trades are likely to rule for sometime as investors have very little obvious alternative at the moment. Option vols are trading near record lows, the spike in US yields that would have supported the dollar, has been eroded since NFP. Apparently South Africa is close to a wage deal – which will support the ZAR – and along with the Kiwi news overnight will only lead to further gains for high yielding currencies. The ‘long’ USD after NFP are not getting any market love – the squeeze is on back by lower USD yields.

Source: marketpulse