Elliott Wave Analysis: USD Index Aiming For 98 Zone

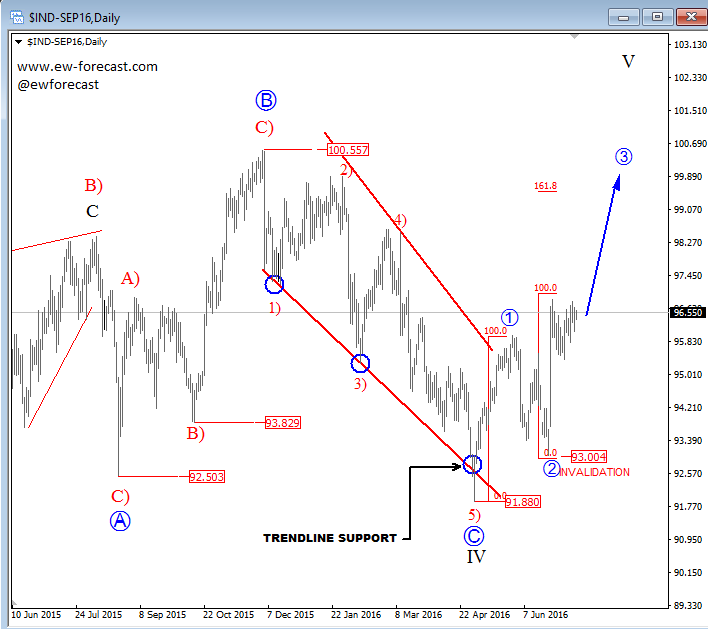

On USD index daily chart we are observing a big sideways pattern since start of 2015; it’s slow, sideways and overlapping price action which is a personality of a contra-trend movement that can be completed now. We see it as a flat correction in black wave IV; a three wave structure where final wave C should be made by five waves. Well, we have seen a nice decline from November of 2015 counted in five legs, but as an ending diagonal. That’s a reversal pattern that already caused a strong bounce in May, so ideally recent sharp leg down was just a pullback labeled as wave two within ongoing uptrend and recent sharp turn to the upside is undergoing wave 3, which could ideally reach 99 region.

On USD index daily chart we are observing a big sideways pattern since start of 2015; it’s slow, sideways and overlapping price action which is a personality of a contra-trend movement that can be completed now. We see it as a flat correction in black wave IV; a three wave structure where final wave C should be made by five waves. Well, we have seen a nice decline from November of 2015 counted in five legs, but as an ending diagonal. That’s a reversal pattern that already caused a strong bounce in May, so ideally recent sharp leg down was just a pullback labeled as wave two within ongoing uptrend and recent sharp turn to the upside is undergoing wave 3, which could ideally reach 99 region.

USD Index, Daily

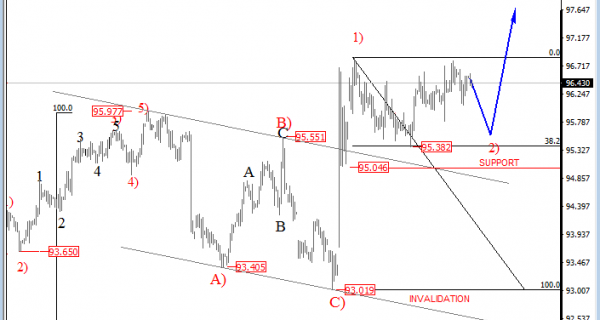

On the lower time frame, price made a nice reversal higher a few weeks back from 93.00 area where a three wave set-back had completed a contra-trend move. Now we think that price could already be in a new bullish sequence which can reach for 98.00 area, but after a completion of a red subwave 2) that can be headed back to to 95.30 region for a support near 38.2% Fibo.

USD Index, 4H

http://www.ew-forecast.com/service

Find more: Contributing Authors