EUR/USD: Listless as German Trade Balance Improves

EUR/USD is showing little movement on Tuesday, as the pair trades just below the 1.36 line. There are no major releases on today’s schedule. In the Eurozone, German Trade Balance posted a wider surplus, as the indicator hit an eight-month low. In the US, today’s highlight is JOLTS Job Openings. The markets are expecting a strong reading in the June release.

There was finally some positive news out of Germany, after a rash of weak data from the Eurozone’s largest economy. Trade Balance improved last month, posting a surplus of EUR 18 billion, the highest reading since last October. This easily surpassed the estimate of EUR 15.7 billion. German retail sales, employment and manufacturing data softened in May, causing concern that a weakening German economy could dash hopes of growth in the Eurozone and hurt the euro.

US employment numbers impressed last week, led by Nonfarm Payrolls and the Unemployment Rate sparkled. Nonfarm Payrolls, one of the most important indicators, bounced back in June with a strong gain of 288 thousand new jobs. This crushed the estimate of 214 thousand. Unemployment Claims was steady at 315 thousand, almost replicating the estimate of 314 thousand. There was more good news from the Unemployment Rate, which continues to move downward. The indicator dipped to 6.1%, its lowest level since September 2008. The strong employment numbers are sure to increase speculation about an interest rate hike by the Federal Reserve, and remarks by Fed policymakers will be under the market microscope.

As widely expected, the ECB maintained the benchmark interest rate at 0.15% at its July policy meeting, held late last week. This was is sharp contrast to the previous meeting, in which the ECB lowered the benchmark rate from 0.25% and introduced negative deposit rates for the first time. At this week’s meeting, ECB head Mario Draghi noted that inflation rates remain very low, and said that the ECB was ready to implement “unconventional instruments” if necessary. As well, Draghi reiterated that the ultra-low interest rates would remain at current levels or lower for the foreseeable future.

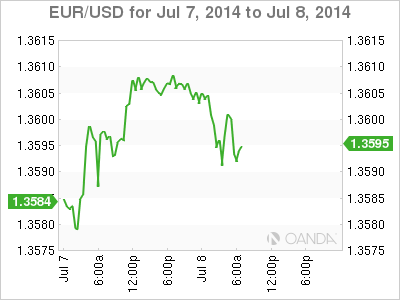

EUR/USD for Tuesday, July 8, 2014

EUR/USD July 8 at 12:10 GMT

EUR/USD 1.3593 H: 1.3610 L: 1.3588

EUR/USD Technical

EUR/USD has hugged the 1.36 line throughout the day, showing very little activity in the Asian and European sessions.

- On the downside, the pair is testing support at 1.3585. Will this line fall? 1.3487 is stronger.

- 1.3651 is the next line of resistance. 1.3786 is next.

- Current range: 1.3585 to 1.3651

Further levels in both directions:

- Below: 1.3585, 1.3487, 1.3346 and 1.3295

- Above: 1.3651, 1.3786, 1.3893 and 1.40

EUR/USD Fundamentals

- 6:00 German Trade Balance. Estimate 15.7B. Actual 18.8B.

- 6:45 French Government Budget Balance. Estimate -64.3B.

- 6:45 French Trade Balance. Estimate -4.1B. Actual -4.9B.

- All Day -ECOFIN Meetings.

- 11:30 NFIB Small Business Index. Estimate 97.3 points. Actual 95.0 points.

- 14:00 US JOLTS Job Openings. Estimate 4.53M.

- 17:45 FOMC Member Narayana Kocherlakota Speaks.

- 19:00 US Consumer Credit. Estimate 21.3B.

*Key releases are highlighted in bold

*All release times are GMT

Source: marketpulse