Gold Prices Steady Ahead of Federal Reserve Minutes

The US economy has been moving in the right direction, but inflation numbers in the US remain at very low levels. On Tuesday, CPI and Core CPI, the primary gauges of consumer inflation, both posted paltry gains of 0.1%. These weak readings come on the heels of PPI, a manufacturing inflation index, which also came in at 0.1% last month. Weak inflation is one reason why the Federal Reserve is in no rush to raise interest rates, as low inflation points to slack in the economy. Meanwhile, US housing numbers were sharp on Tuesday. Building Permits improved to 1.05 million, beating the estimate of 1.00 million. Housing Starts jumped to 1.09 million, easily beating the estimate of 0.97 million.

All eyes are on the Federal Reserve, which will release the minutes of its last policy meeting later on Wednesday. Traders looking for clues as to when the Fed will press the trigger and raise interest rates, but Fed chair Janet Yellen might not oblige. US growth numbers have been positive, but job data could be better and inflation remains very low. The Fed’s asset purchase program (QE) is scheduled to wind up in October, and a rate hike appears to be a question of timing.

Financial leaders and central bankers from around the world will gather in Jackson Hole, Wyoming for a conference which starts on Friday. This will be Janet Yellen’s first appearance as Fed chair at the conference, and will undoubtedly be the star of the show. Yellen is expected to discuss the employment market rather than monetary policy, but the markets will be listening closely for any hints as to an interest rate hike.

Gold is stable in Wednesday trading, as the metal continues to stay close to the key $1300 level. The spot price stands at $1297.16 per ounce in the European session. It’s a quiet day on the release front, highlighted by the Federal Reserve minutes, which should be treated by traders as a market-mover.

Inflation numbers in the US remain at very low levels. On Tuesday, CPI and Core CPI, the primary gauges of consumer inflation, both posted paltry gains of 0.1%. These weak readings come on the heels of PPI, a manufacturing inflation index, which also came in at 0.1% last month. Weak inflation is one reason why the Federal Reserve is in no rush to raise interest rates, as low inflation points to slack in the economy.

On the employment front, last week’s Unemployment Claims came in higher than expected. The indicator climbed to 311 thousand, marking a six-week high. The estimate stood at 307 thousand. Employment indicators are being closely scrutinized by analysts, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate increase is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a move by the Fed. Meanwhile, consumer confidence and retail sales disappointed last week. This means that an improvement in the US labor market has not translated into stronger consumer confidence and spending, which are critical for economic growth.

Financial leaders and central bankers from around the world will gather in Jackson Hole, Wyoming for a conference which starts on Friday. This will be Janet Yellen’s first appearance as Fed chair at the conference, and will undoubtedly be the star of the show. Yellen is expected to discuss the employment market rather than monetary policy, but the markets will be listening closely for any hints as to an interest rate hike.

Hotspots in Ukraine and the Middle East remain tense and could have dramatic effects on the markets. In eastern Ukraine, more fighting has been reported between Ukrainian forces and pro-Russian separatists, and large numbers of Russian forces remain close to the border. In Iraq, Kurdish forces, aided by US air strikes, are battling with Islamic State militants. As political turmoil continues in Iraq, the national government is becoming increasingly irrelevant. In Gaza, the fighting has renewed between Israel and Hamas as the latest ceasefire broke down on Tuesday.

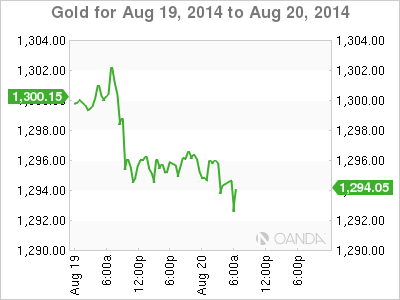

XAU/USD for Wednesday, August 20, 2014

XAU/USD August 20 at 11:30 GMT

XAU/USD 1294.75 H: 1297.16 L: 1291.73

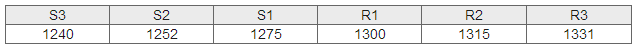

XAU/USD Technical

- XAU/USD is showing little activity, as the pair trades just shy of the 1300 level.

- 1300 has reverted to a resistance role and is a weak line. 1315 is stronger.

- 1275 is providing support.

- Current range: 1300 to 1315.

Further levels in both directions:

- Below: 1275, 1252, 1240 and 1210

- Above: 1300, 1315, 1331 and 1345

XAU/USD Fundamentals

- 14:30 US Crude Oil Inventories. Estimate -1.3M.

- 18:00 US FOMC Meeting Minutes.

*Key releases are highlighted in bold

*All release times are GMT

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Source: marketpulse