FXCM Provides Further Details on Financing With Leucadia National Corporation

Further to the announcement that Leucadia is investing $300 million in cash into FXCM, the leading online provider of foreign exchange issued a stattement with further details on the financing.

Read also the announcement Leucadia is investing $300 million in cash into FXCM to Permit FXCM to Continue

FXCM Inc. (NYSE:FXCM), a leading online provider of foreign exchange, or FX, trading and related services, today announced further details on the agreement reached with Leucadia National Corporation (“Leucadia”) that permitted FXCM to meet its regulatory capital requirements and continue normal operations after significant losses were incurred due to unprecedented actions by the Swiss National Bank.

As a result of customer debit balances following the historic movement of the Swiss Franc on January 15, 2015, regulators required FXCM Inc.’s regulated entities to supplement their respective net capital on an expedited basis. FXCM Inc. (“FXCM”) thereafter explored multiple debt and equity financing alternatives. As previously announced, FXCM reached a financing agreement with Leucadia on January 16, 2015. FXCM is now in compliance with all regulatory capital requirements in the jurisdictions in which it operates. Trading on FXCM’s systems continues in the normal course of business.

FXCM Holdings, LLC (“Holdings”) and FXCM Newco, LLC (“Newco”), a newly-formed wholly-owned subsidiary of Holdings, entered into a credit agreement with Leucadia on January 16, 2015 for a $300 million, two-year term loan. The net proceeds of the loan (approximately $279 million) will replace capital in FXCM regulated entities to cover negative client balances and pay down outstanding revolving debt. In connection with the credit agreement, Holdings formed Newco and contributed all of the equity interests owned by Holdings in its subsidiaries to Newco.

The loan has an initial interest rate of 10% per annum, increasing by 1.5% per annum each quarter for so long as it is outstanding, but in no event exceeding 17% per annum (before giving effect to any applicable default rate). It is also subject to various conditions and terms such as requiring mandatory prepayments, including from proceeds of dispositions, condemnation and insurance proceeds, debt issuances, and equity issuances. The credit agreement includes a variety of restrictive covenants, including, but not limited to, limitations on the ability to merge, dissolve, liquidate, consolidate or sell, lease or otherwise transfer all or substantially all assets; limitations on the incurrence of liens; limitations on the incurrence of debt by subsidiaries of the company; and limitations on transactions with affiliates, without the prior consent of the lender.

The credit agreement requires monthly payments of the term loan from proceeds received during the immediately preceding calendar month from accounts receivable related to the customer debit balances referenced above. The obligations under the loan are guaranteed by certain domestic subsidiaries of Holdings and secured by substantially all of the assets of Holdings and certain of its subsidiaries. The credit agreement also requires the borrowers to pay a deferred financing fee in an amount equal to $10 million, with an additional fee of up to $30 million becoming payable in the event the aggregate principal amount of the term loan outstanding on April 16, 2015 is greater than $250 million or the deferred financing fee of $10 million (plus interest) has not been paid on or before such date.

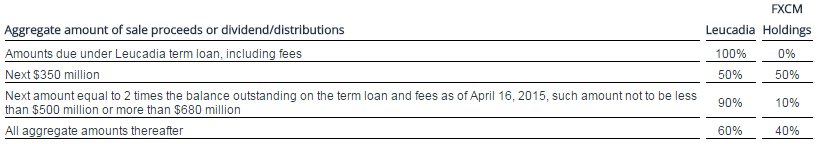

In connection with the financing, the parties also entered into an agreement that provides, among other things, that Newco will pay in cash to Leucadia and its assignees a percentage of the proceeds received in connection with certain transactions, including any sale of assets, any dividend or distribution or the sale or indirect sale of Newco (whether by merger, stock purchase, sale of all or substantially all of Newco’s assets or otherwise). That agreement, which remains in place until the sale of Newco, allocates proceeds as follows:

In addition, FXCM, Holdings and Newco have agreed that beginning in three years and thereafter, upon the request of Leucadia or its assignees, they will cause the sale of Newco at the highest reasonably available price. Upon the occurrence of such event, Newco will pay Leucadia and its assignees in accordance with the methodology described above.

The parties are in the process of finalizing certain terms to this arrangement and expect to file a Form 8-K with the SEC.

Drew Niv, Chief Executive Officer of FXCM, stated: “We could not be more grateful to the Leucadia and Jefferies team for their rapid and effective response to work with us through this challenging process. Their financing and ongoing support will enable us to continue to provide the highest quality service to our customers and act as the leading online provider of foreign exchange trading and related services to retail and institutional customers worldwide.”

Richard B. Handler, Chief Executive Officer, and Brian P. Friedman, President of Leucadia, stated: “We are pleased to have been able to provide this critical financing to FXCM that is designed to maintain FXCM’s financial strength and allow it to prosper going forward. We believe this is an attractive investment for Leucadia and we look forward to a mutually beneficial relationship with FXCM management. We want to thank the entire FXCM team, with whom Leucadia and Jefferies worked to achieve this solution for FXCM.”

FXCM would also like to provide clarification regarding the press release dated January 16, 2015, which stated that UBS acted as financial advisor on the transaction. UBS advised FXCM in its capacity as placement agent in exploring financing alternatives, excluding debt financing and the debt financing provided by Leucadia.

Source: FXCM – FXCM Provides Further Details on Financing With Leucadia National Corporation