A potential crisis in Comex gold

We are all used to the bullion banks covering their shorts on Comex by waiting until the speculators are over-bullish and vulnerable to mark-downs that trigger their stops. Algorithmic traders go from long to short in a heartbeat as well, and they dump contracts into a falling market, speeding up the decline. We should say at this juncture that the Managed Money speculators are short-term, attracted by futures leverage, and their gold position is often part of a wider risk strategy deployed by hedge funds. They do not intend to stand for delivery. The wider investment world taking strategic portfolio decisions does not often get involved with gold, so the Comex gold contract has been a secular play.

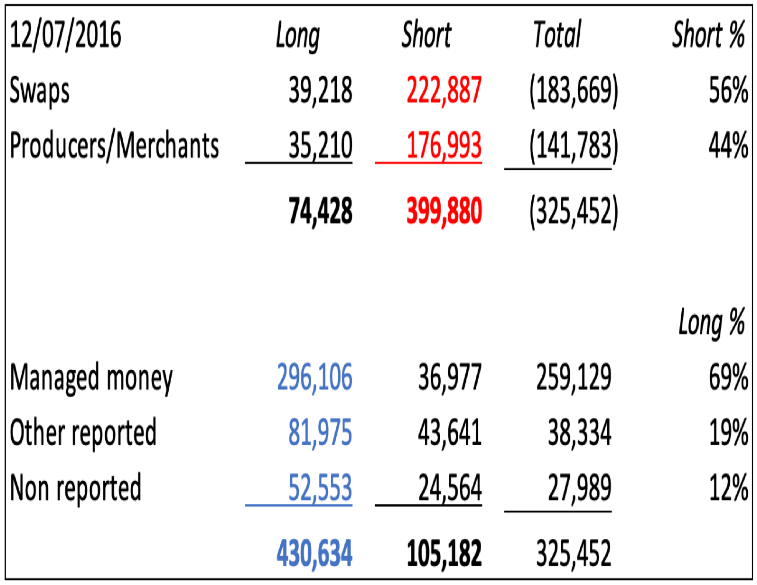

The table below shows a typical set-up, in this case July 2016. The Managed Money category (296,106 — net 259,129 contracts) is close to record long. Open interest was 633,000 contracts and the gold price was at $1360, having run up from $1040 the previous December.

In the non-speculative category, the bullion banks (Swaps) had 56% of the shorts and the Producer/Merchants 44%. Mark-to-market value of the Swaps net short position was $25bn. Of the speculative longs, the managed money category (hedge funds) held 69%, and at 296,106 long contracts it was almost a record. There was a high level of bullishness; easy pickings for the bullion banks, who by the following December drove the price down to $1120, reducing their net shorts to under 50,000 contracts.

It was a game that evolved out of Comex futures being used simply to offset long bullion positions at the LBMA. Over time, bullion bank traders increased their trading position limits, as opposed to their pure hedging activity, making easy money jobbing the other side of Managed Money trades.

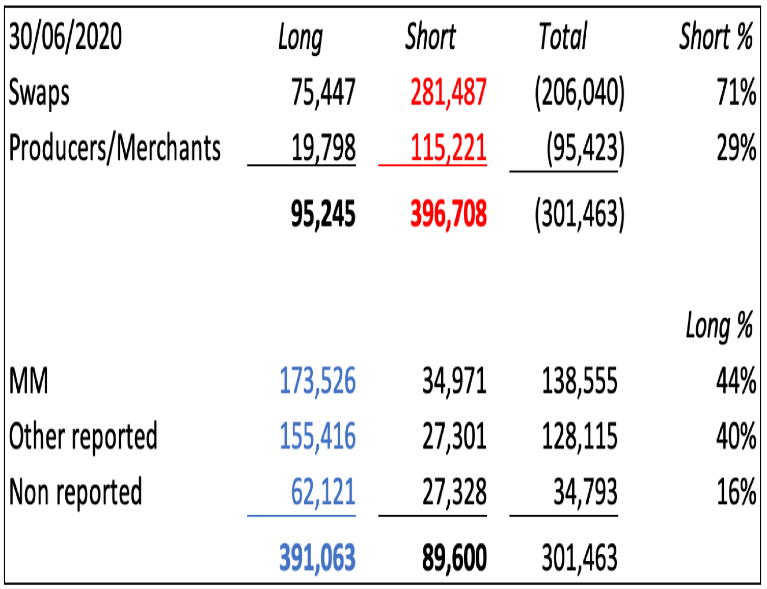

Now look at the current situation, with the gold price at decade highs ($1775) and open interest at 561,628 (30 June).

In the non-speculator category, the Swaps are more short than they were in July 2016 despite open interest being 71,372 contracts lower. The mark-to-market value is record net short at $36.6 billion. What has happened is the Producer/Merchants have cut their positions, presumably deciding that hedging mine output is less important in the current inflationary environment. Consequently, the bullion banks are bearing 71% of the short exposure.

The speculator category makes this more interesting still. At 138,555 net long, hedge funds are only 25,000 contracts longer than average, and compared with their bullishness in July 2016 have hardly got going. It is the other categories, Other Reported and Non-reported have taken 56% of the long side, and they are not behaving like skittish hedge funds at all. These include family offices, the ultra-wealthy and foreigners through Globex who are standing for delivery as a means of getting their hands on physical bullion —171 tonnes from the June contract alone.

Conclusion

Bullion banks are between a rock and a hard place. For years they’ve been playing the hedge funds as an angler hooks and plays a fish. That game has ceased and there is no easy way for them to get level. For the moment they are trying to put a lid on the price, but the cost has been rising open interest, and therefore rising mark-to-market positions.

The August active contract runs off the board at the end of this month and bullion banks are likely to be forced into large delivery volumes again. Furthermore, the exchange for delivery arbitrage facility between Comex and the LBMA is broken, allowing Comex premiums to London spot to go unchallenged.

It is increasingly possible the gold contract is evolving into deep crisis, and that force majeure might have to be declared if, as seems increasingly inevitable, a wider banking crisis ensues.

By Alasdair Macleod, www.goldmoney.com

Find more: Contributing Authors