EURAUD, EURCAD Both Looking Bearish – Elliott wave Analysis

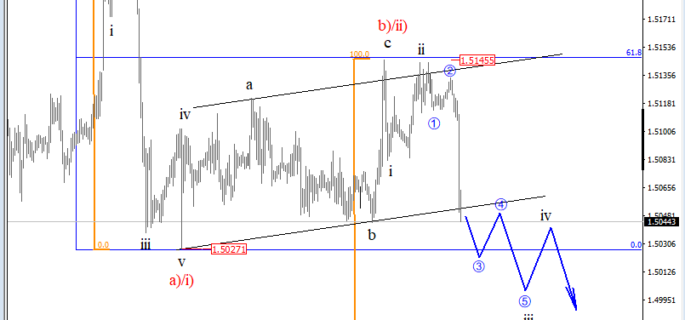

EURAUD made a break out of a corrective channel line which was connected from twelve of March. We see this impulsive break as a suggestion that a higher degree wave b correction had ended at the 1.605 level, and that a new, bigger, five-wave price development can now be in progress. We can see the first five-wave move as completed; labelled as wave i) which was then followed by a temporary three-wave pullback labelled as wave ii). Current sharp drop, that is approaching the 1.5945 level can now be an indication that wave iii) of a higher degree wave c is in play, and that more weakness may be in store for the pair.

In case we see a new rally towards the 1.605 level, then this would invalidated our count.

EURAUD, 1h

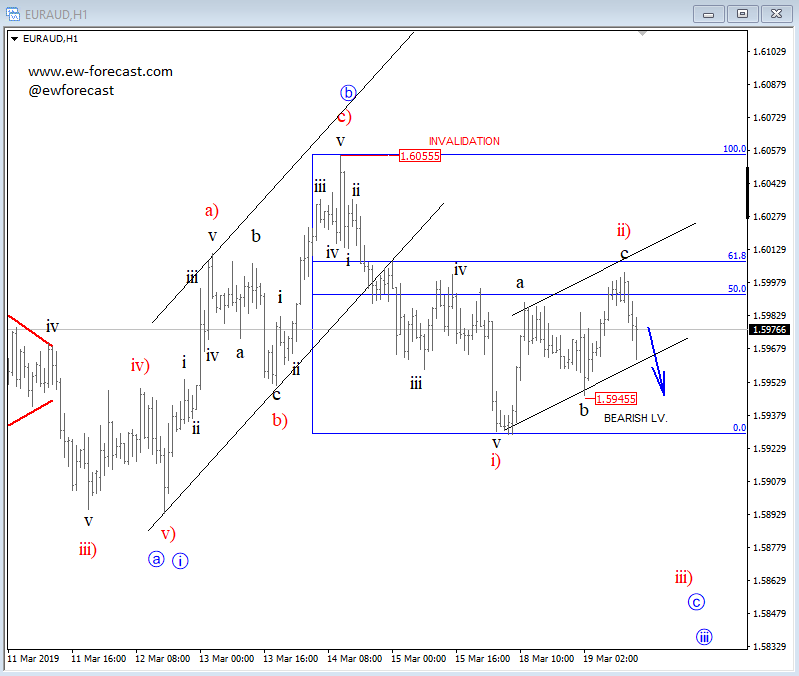

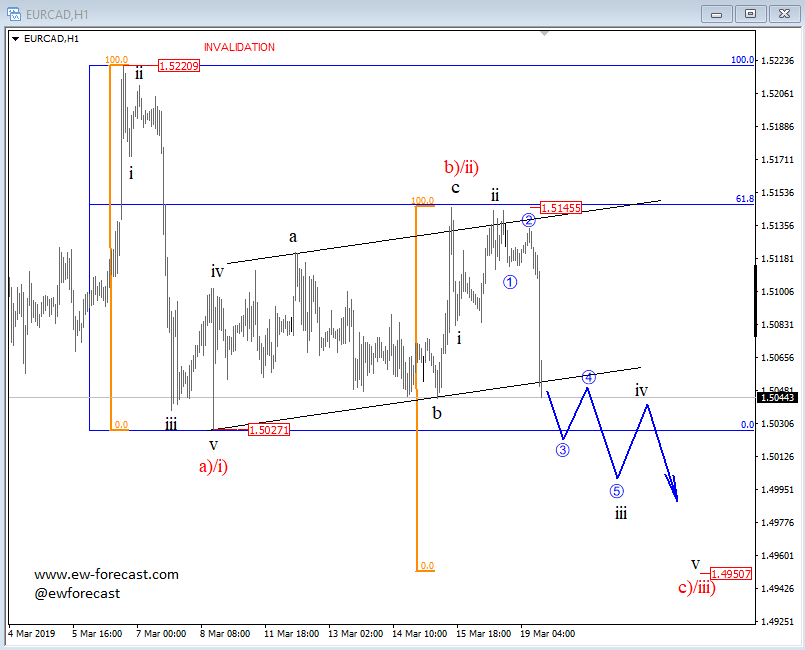

EURCAD made a perfect drop away from important 61,8% Fibo. retracement and it’s currently moving lower. So, we see room for more weakness within five waves down towards 1.4950 area for wave c) or maybe even iii), especially if EURUSD finds resistance.

EURCAD, 1h

Disclosure: Please be informed that information we provide is NOT trading recommendation or investment advice. All of our work is for educational purposes only.

http://www.ew-forecast.com/service

Find more: Contributing Authors